EXPLAINABLE FINANCIAL AI:

THE HEART OF REALRATE

At RealRate, we leverage cutting-edge, explainable financial AI to deliver clear and actionable financial insights. Our proprietary causal graphs — renowned for their clarity — go beyond the numbers to explain the „why“ behind financial performance. Using a fully transparent, data-driven methodology, our AI analyzes financial statements to reveal the key factors that truly impact company outcomes.

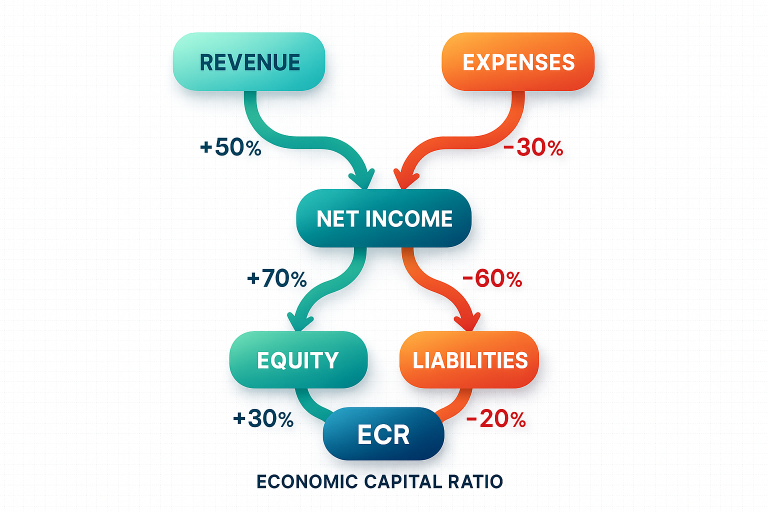

A key part of our analysis is the Economic Capital Ratio — the ratio of company valuation and total assets — which serves as a robust indicator of financial health. Our award-winning approach uniquely combines the power of AI with expert systems, offering a level of transparency, objectivity, and interpretability unmatched in the industry.

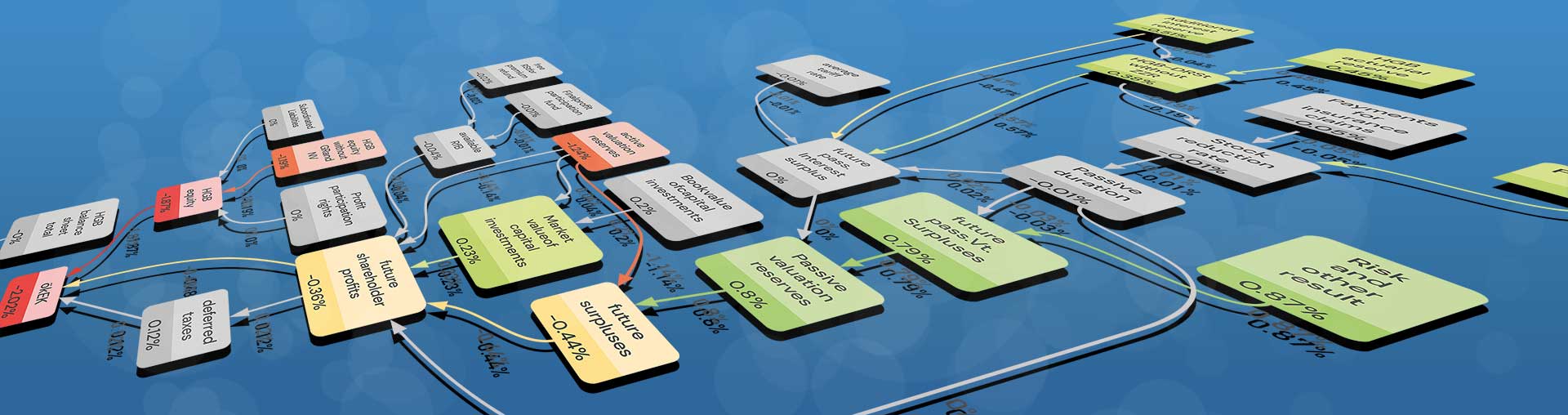

Our core technology is rooted in Explainable Financial AI, a groundbreaking approach that brings clarity to complex financial evaluations. Alongside with the ratings, our AI also produces causal graphs and reports with transparent and interpretable insights, allowing everyone from managers and directors to regulators to see why a company receives a specific rating. They can easily interpret their financial situations from our graphs and reports and can make strategic decisions for improvement.

Through advanced causal modeling and economic theory, our algorithms analyze what truly drives performance—not just correlation, but real, explainable causation. We combine the power of AI with the rigor of finance to deliver financial truth that you can trust.

No more guesswork. Our AI clearly shows the why behind every valuation. Each score comes with a breakdown of contributing factors, enabling full insight and confidence in decision-making.

Backed by deep economic modeling, our financial health valuations aren’t influenced by politics or subjective opinions. Our data is objective, our process is scientific, and our outcomes are stable.

Our models are designed to be unbiased and equitable. Companies are rated based solely on their true economic performance and risk factors—nothing else. Everyone plays on a level field.

At RealRate, we offer different solutions for different audiences’ needs. Whether you’re an investor seeking transparency, a company striving for credibility, or an institution aiming for objective analysis, we can help you achieve your goals. We also provide solutions for SMEs, sales professionals and logistics.

RealRate uniquely combines economic logic with AI innovation. We analyze data using causal inference, not correlation, and base our insights on fundamental business truths—not market hype or subjective judgment.

Our financial performance valuations are independent, explainable, and always rooted in facts. With every analysis, we show exactly how company metrics affect outcomes—empowering stakeholders to understand, question, and trust our results. Our causal graph shows the breakdown of each factors contributing to the company’s overall financial performance.

At RealRate, we are proud to have received prestigious awards for innovation in recognition of our groundbreaking work in explainable AI. Unlike traditional black-box models, our AI delivers transparent, objective, and easily understandable financial valuations, making complex data accessible and actionable. This commitment to clarity and fairness has set us apart in the financial analytics industry, enabling investors, companies, and regulators to make better-informed decisions.

We take pride in helping businesses gain trust and credibility through our differentiated services. One such success story comes from a satisfied client who shared a glowing review after displaying the RealRate Top-rated Seal on their website. They reported a noticeable boost in customer confidence and sales, attributing to their over all financial growth. Their story is a testament to how powerful trust can be when it’s backed by reliable and independent third party validation.

“The Real Rate seal on the financial strength of German life insurers is a valuable element in our customer communication. It is used on various channels, such as our website or on product presentations. As a neutral and scientifically based proof of our financial strength, the seal builds trust with our customers and partners.”

Experience a smarter and fairer way to evaluate risk and value. Our explainable AI combined with expert system ensures transparency, reliability and innovation in every step of the way, whether it is for financial health valuation or consultation for future growth.

Real data. Real intelligence. RealRate.

If you find our solutions any fit for your needs, please feel free to reach out to us via email : holger.bartel@realrate.ai . We will have you scheduled for our free call to discuss your needs in details.