Source: https://openai.com/dall-e-3/

The results for RealRate’s 2024 ranking for U.S. Real Estate are in and are ranked, as always, by financial strength!

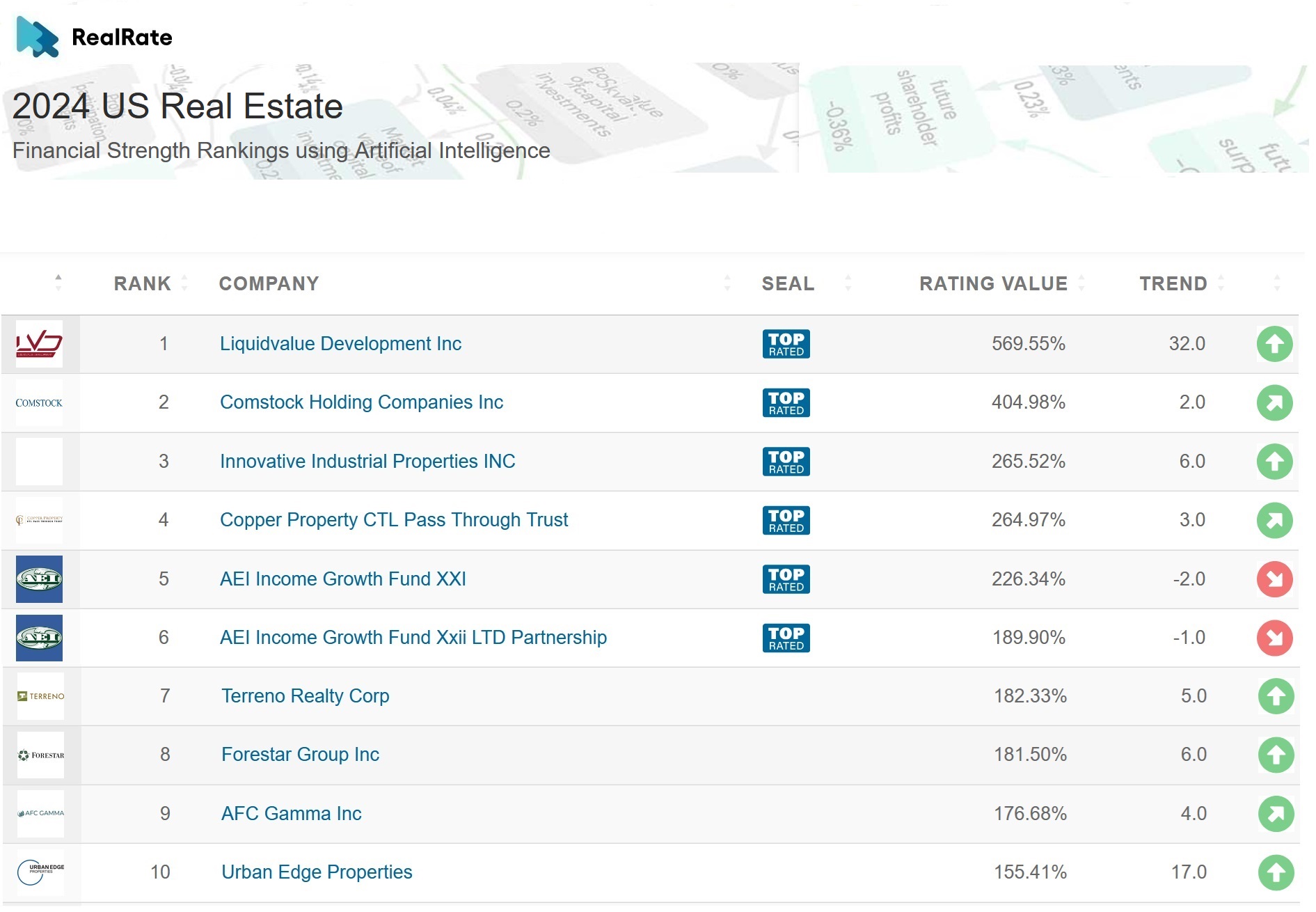

The Top 10 Real Estate companies are as follows:

Source: https://realrate.ai/rankings/

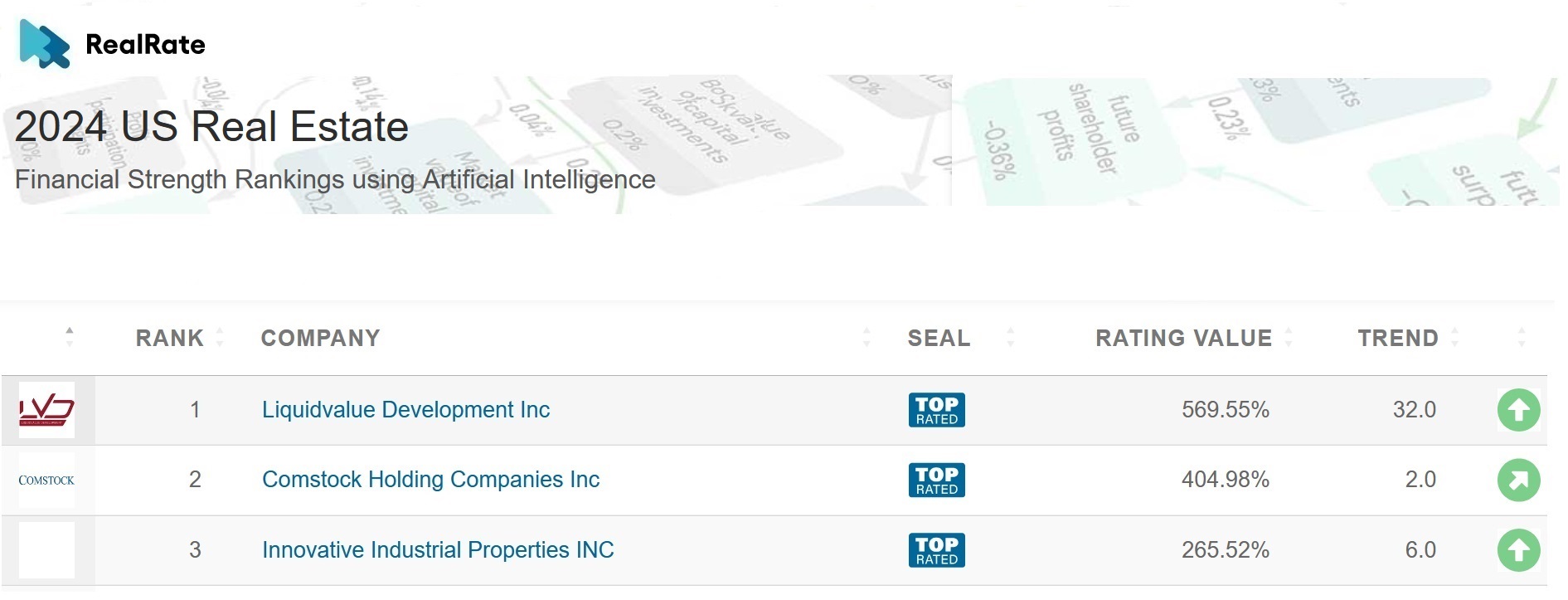

The top 3 Real Estate companies in order are Liquidvalue Development Inc., Comstock Holding Companies Inc., and Innovative Industrial Properties Inc.

They had Economic Capital Ratio figures of 570%, 405%, and 266%, respectively.

Liquidvalue Development and Comstock Holding Companies did well due to powerful Other Revenue scores, increasing the companies’ Economic Capital Ratio scores by 793 and 1076 percentage points, respectively. Innovative Industrial Properties had a strong Lease Income score, increasing its Economic Capital Ratio by 201 percentage points.

Liquidvalue Development climbed an extremely impressive 32 places since 2023 to take the top spot this year. Comstock Holding Companies climbed 2 places to take 2nd, and Innovative Industrial Properties climbed 6 places to move itself into 3rd spot this year.

From a total of 27 Real Estate companies, 6 received our coveted ‘Top-Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-3/

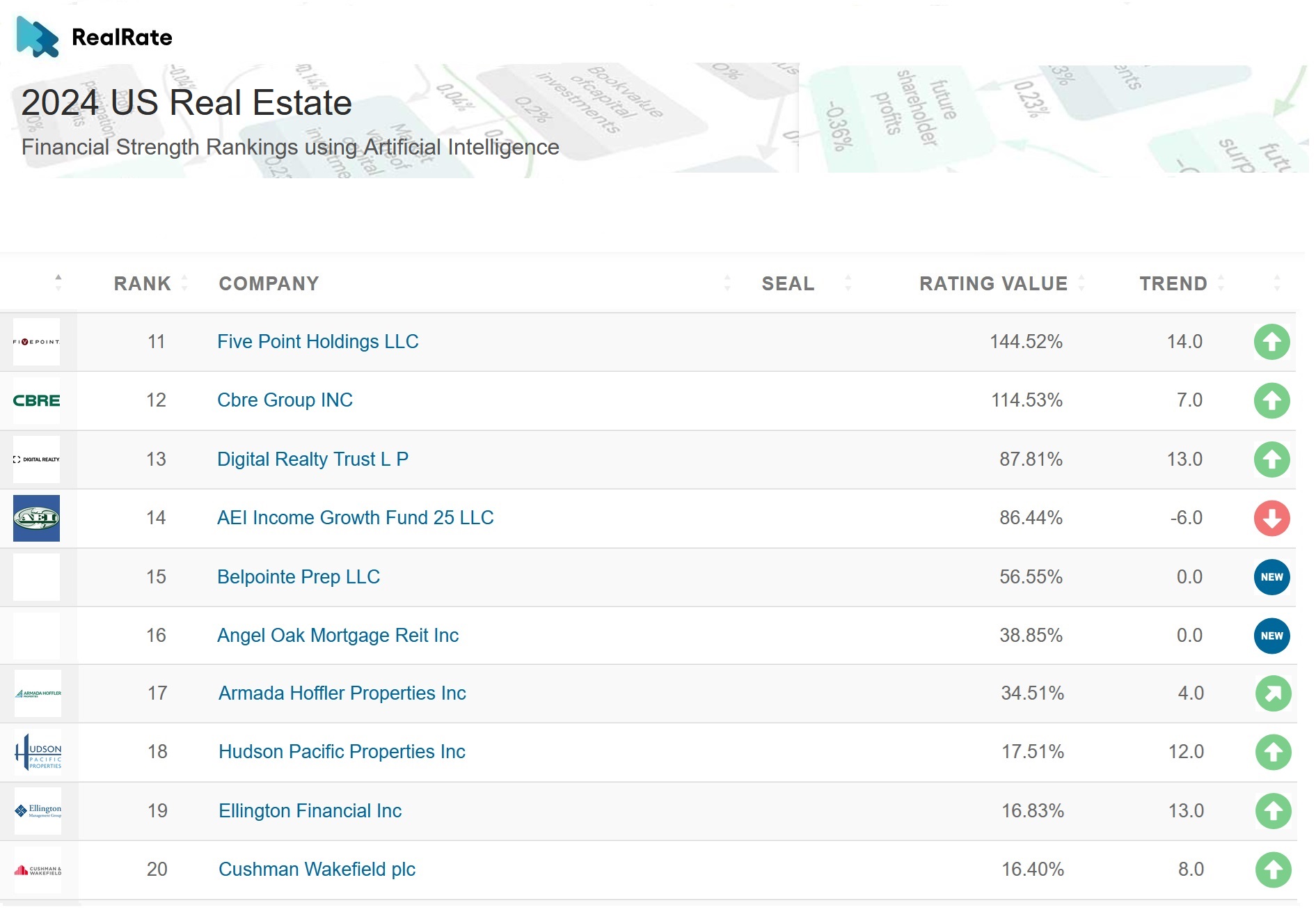

The next 10 Real Estate companies are as follows:

Source: https://realrate.ai/rankings/

The American real estate industry is a massive sector, generating around $5.2 trillion annually.

It includes residential, commercial, and industrial properties, driven by factors like economic growth, interest rates, and population trends. The industry also plays a crucial role in employment and investment opportunities across the U.S. economy.

The impressive thing we do at RealRate is to deliver utterly fair and independent company ratings, bringing together expert knowledge and innovative artificial intelligence in one package.

Our AI model computes the all-important Economic Capital Ratio figure.

Looking at our model in more detail, one can see it is very much unbiased and only uses audited public data. We are not part of any real estate company.

We are fair, explain ourselves very well and we also avoid any all-important conflicts of interest.