Source: https://openai.com/dall-e-3/

The results for RealRate’s 2024 ranking for the German Health Insurance industry are in and are ranked, as ever, by financial strength!

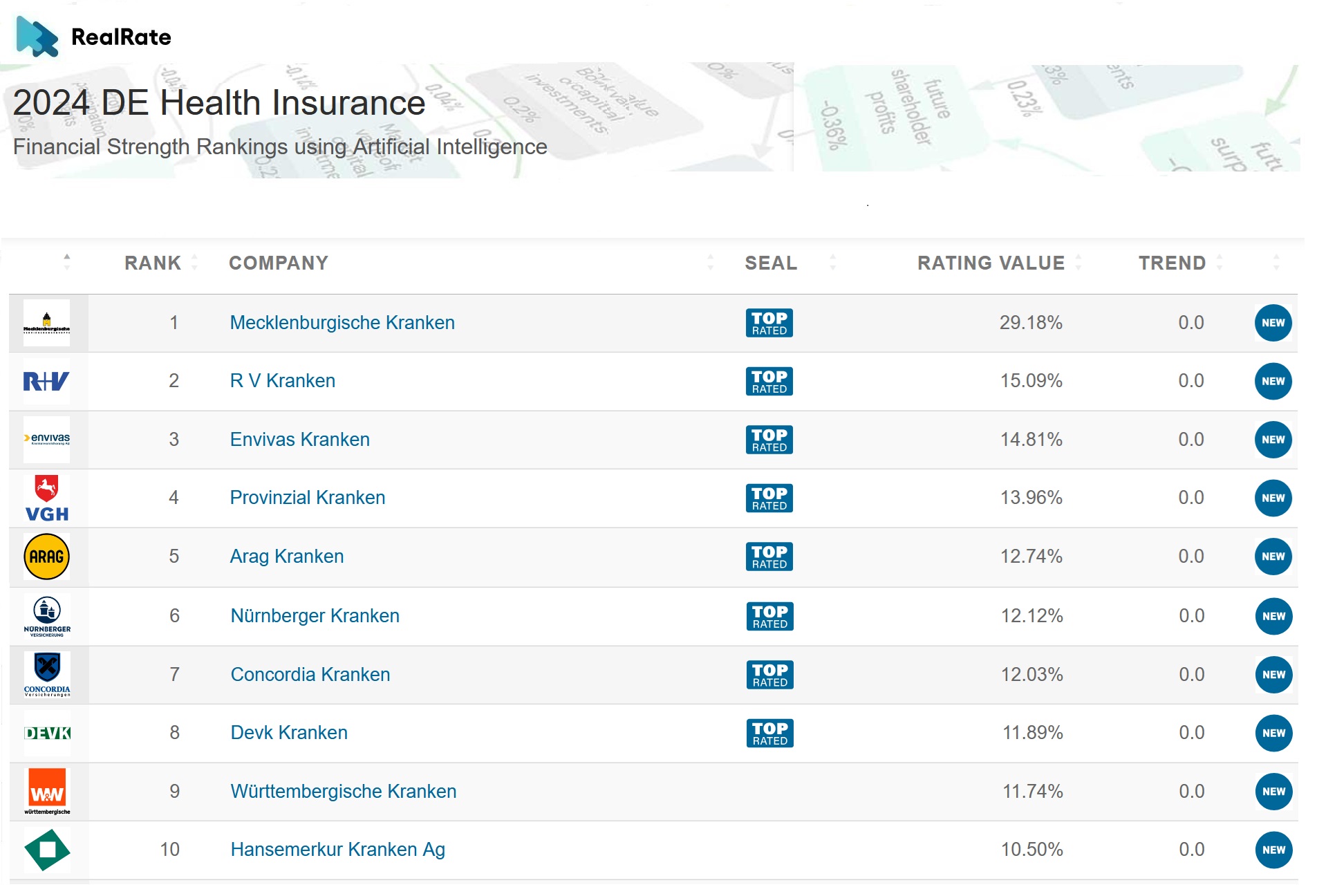

The Top 10 Health Insurance companies are as follows:

Source: https://realrate.ai/rankings/

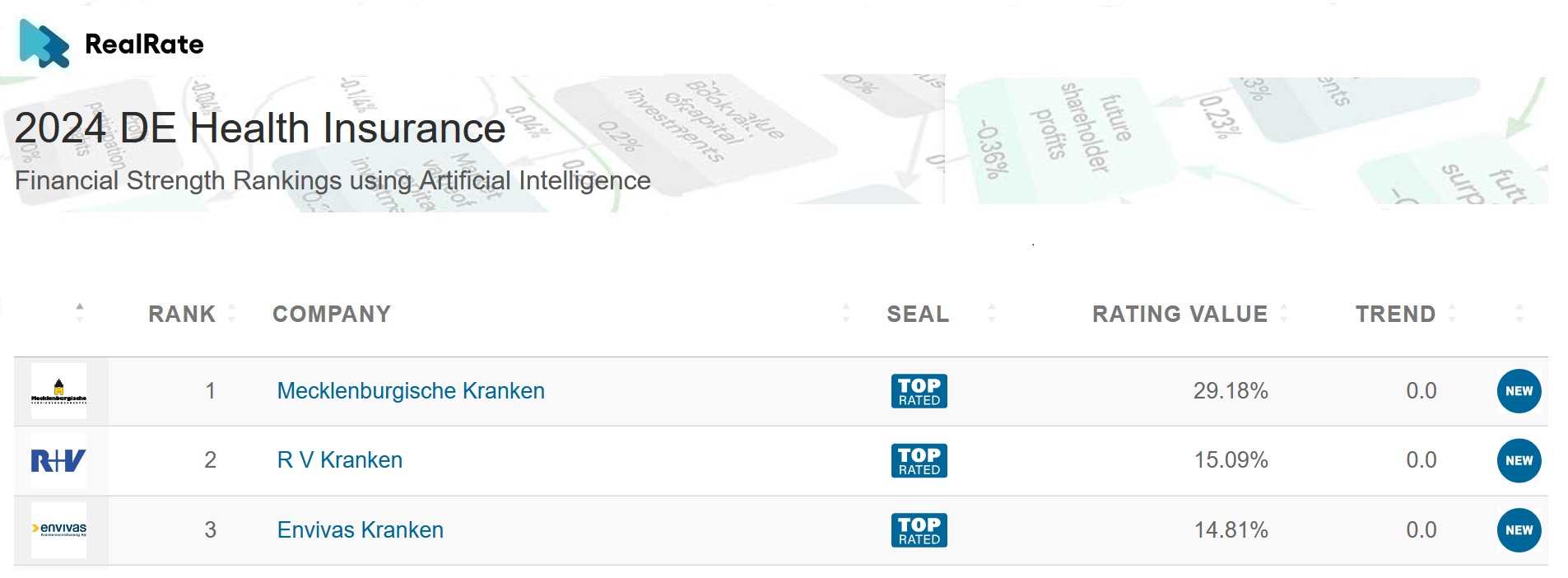

The top 3 Health Insurance companies in order are Mecklenburgische Kranken, R+V Kranken, and Envivas Krankenversicherung.

They had Economic Capital Ratio figures of 29%, 15%, and 14%, respectively.

Mecklenburgische Kranken and R+V Kranken did well due to their Future Shareholder profits variables, and Envivas Krankenversicherung did well due to the Risk and Other Result variable. These increased the companies’ Economic Capital Ratio scores by 17, 4.6, and 4.5 percentage points, respectively.

All 3 companies retain their positions from 2023, amazing consolidation from all!

From a total of 32 Health Insurance companies, 8 received our sought after ‘Top-Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-3/

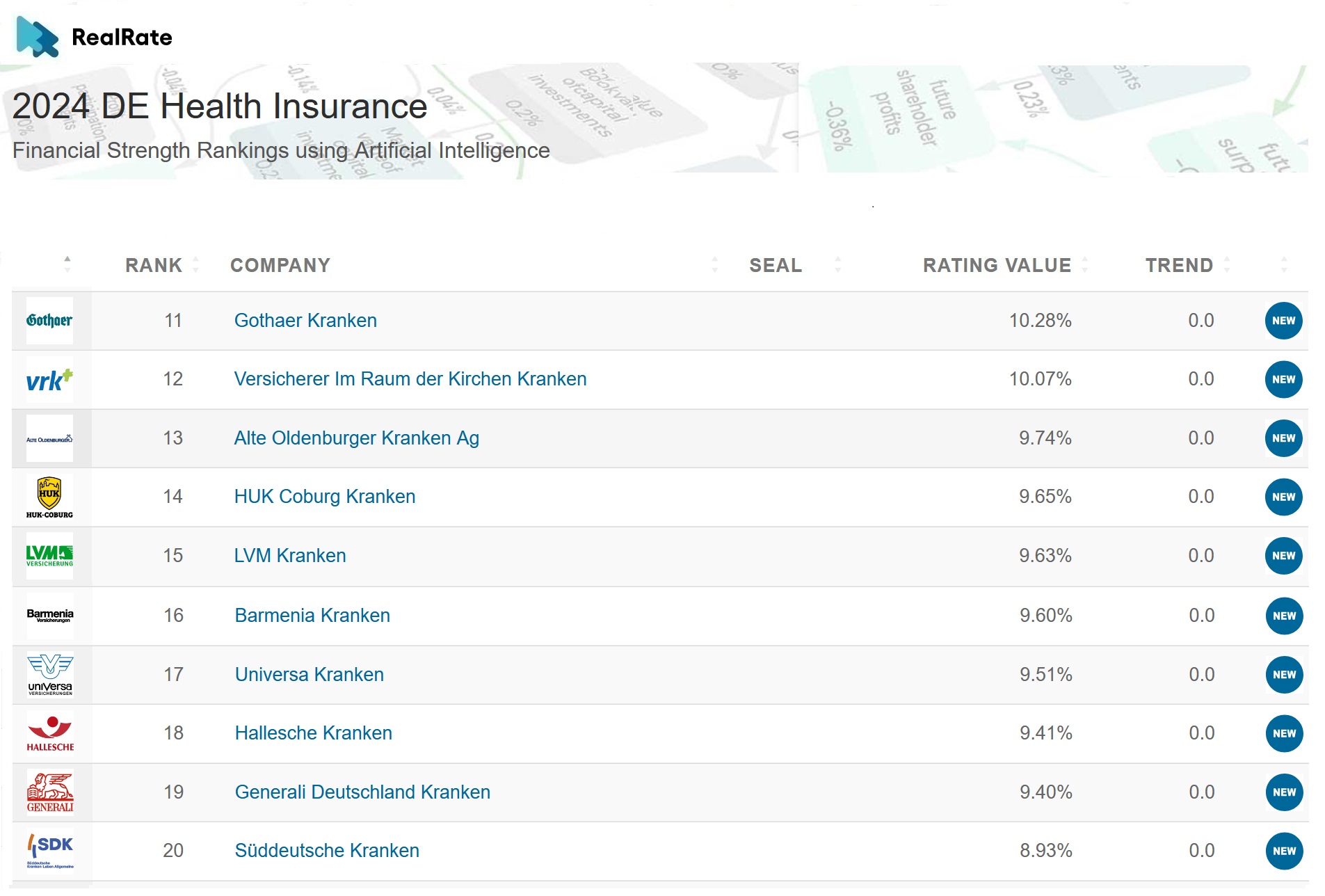

The next 10 Health Insurance companies are as follows:

Source: https://realrate.ai/rankings/

The German private health insurance sector is a significant part of the country’s healthcare system.

This sector primarily serves high-income earners, the self-employed, and civil servants, who opt for private insurance over statutory health insurance due to its broader coverage and personalized services.

It accounts for around 10% of the population and is supported by a competitive market comprising major players like Allianz, Debeka, and AXA.

You can only sign up if you fall into one of these categories:

- If you earn over €60,750 per year

- If you earn under €450 per month

- Students aged between 23-30

- Self-employed individuals

- Civil servants (as insurance is subsidized by the employer)

There are just over 40 companies offering private health insurance and the market is worth a colossal €49 billion.

The incredible thing we do at RealRate is to deliver fair and independent ratings, bringing together expert knowledge with innovative artificial intelligence.

We use both to compute the Economic Capital Ratio figure.

We are unbiased and work only with audited public data. We are not only fair but also explainable and have no conflicts of interest.