Source: https://openai.com/dall-e-3/

The results for RealRate’s 2024 ranking for the German Life Insurance industry are in and are ranked, as ever, by financial strength!

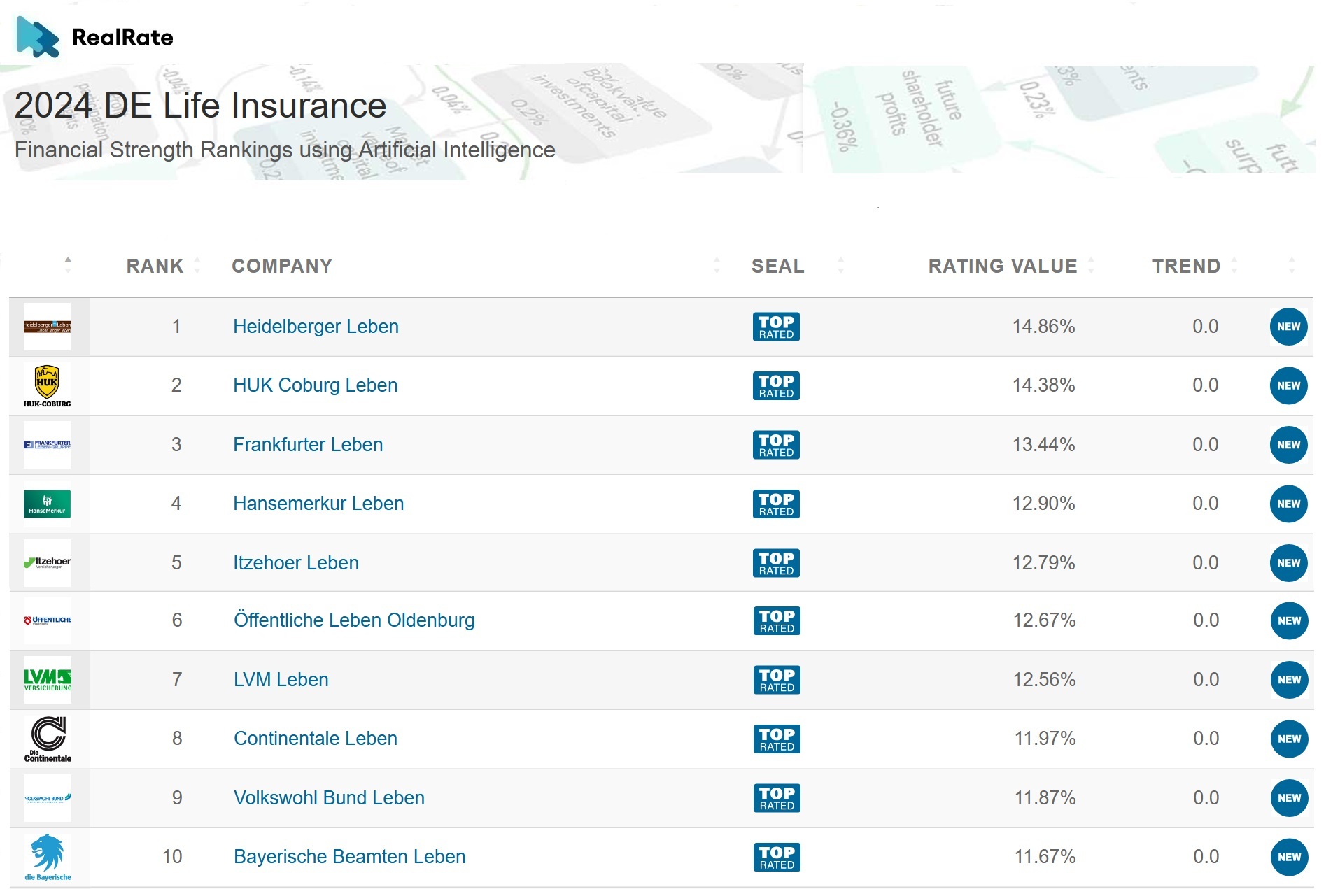

The Top 10 Life Insurance companies are as follows:

Source: https://realrate.ai/rankings/

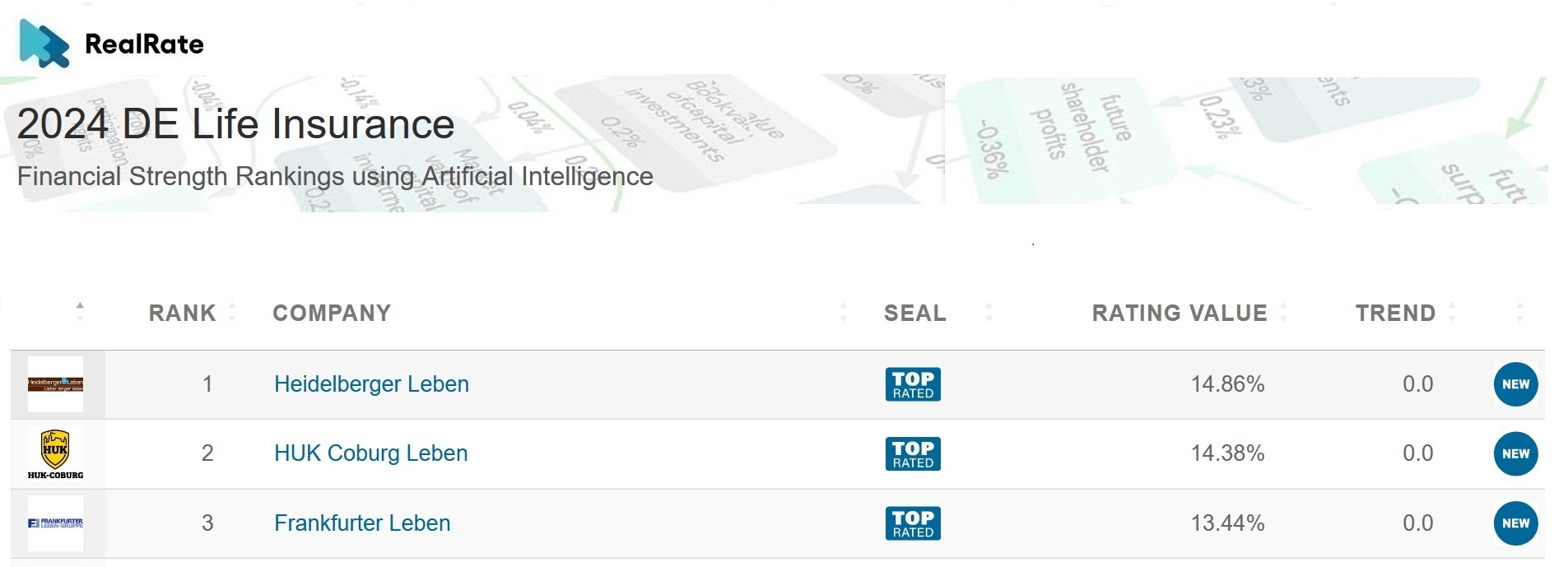

The top 3 Life Insurance companies in order are Heidelberger Leben, HUK-Coburg Leben, and Frankfurter Leben.

They had Economic Capital Ratio figures of 15%, 14%, and 13%, respectively.

Heidelberger Leben did well due to its Hidden reserves on Liabilities score, HUK Coburg because of its Statutory equity without subordinated loans figure, and Franfurter Leben due to a strong Future Shareholder Profits figure. These increased the companies’ Economic Capital Ratio scores by 9.7, 3.1, and 3.7 percentage points, respectively.

Heidelberger Leben moved up 21 places since last year to take the top spot. HUK Coburg slip down 1 spot into 2nd, and Franfurter Leben move up a massive 53 places to take the 3rd spot.

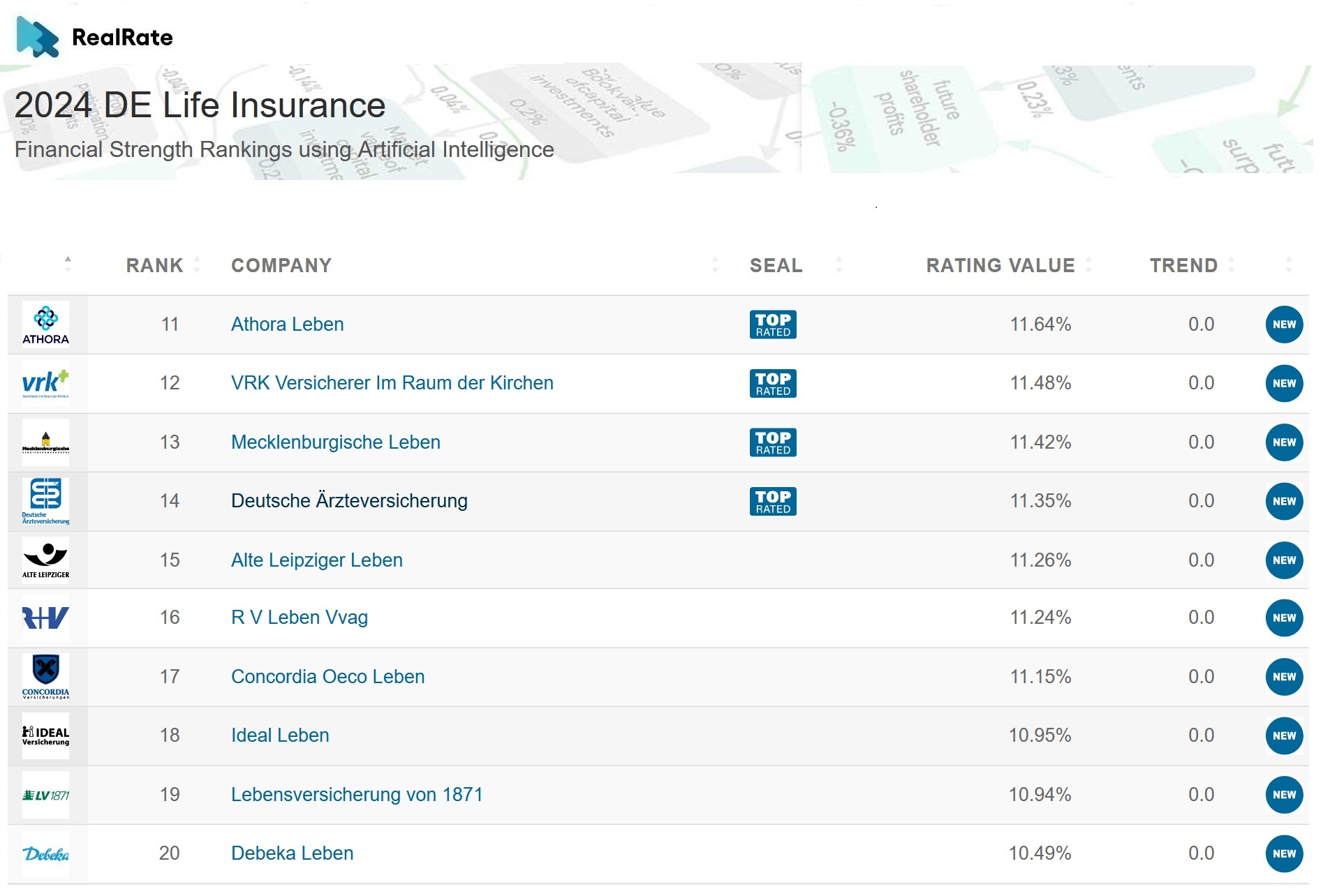

From a total of 59 Life Insurance companies, 14 received our sought after Top-Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-3/

The next 10 Life Insurance companies are as follows:

Source: https://realrate.ai/rankings/

The German life insurance sector is a key component of the country’s financial industry, generating approximately €106 billion in revenue in 2023 with over 30 million active policies.

It is expected to see modest annual growth of around 1.8% through 2028, driven by demand for old-age provision products. Leading providers include Allianz, Generali, and R+V Versicherung.

The incredible thing we do here at RealRate is to deliver fair and independent ratings, bringing together expert knowledge with innovative artificial intelligence.

RealRate brings to the market a rating system that is truly independent and fair.

We have expert knowledge and use innovative artificial intelligence to compute the Economic Capital Ratio figure.

We are unbiased and work only with audited public data. We are not only fair but also explainable and have no conflicts of interest.