Source: https://openai.com/dall-e-3/

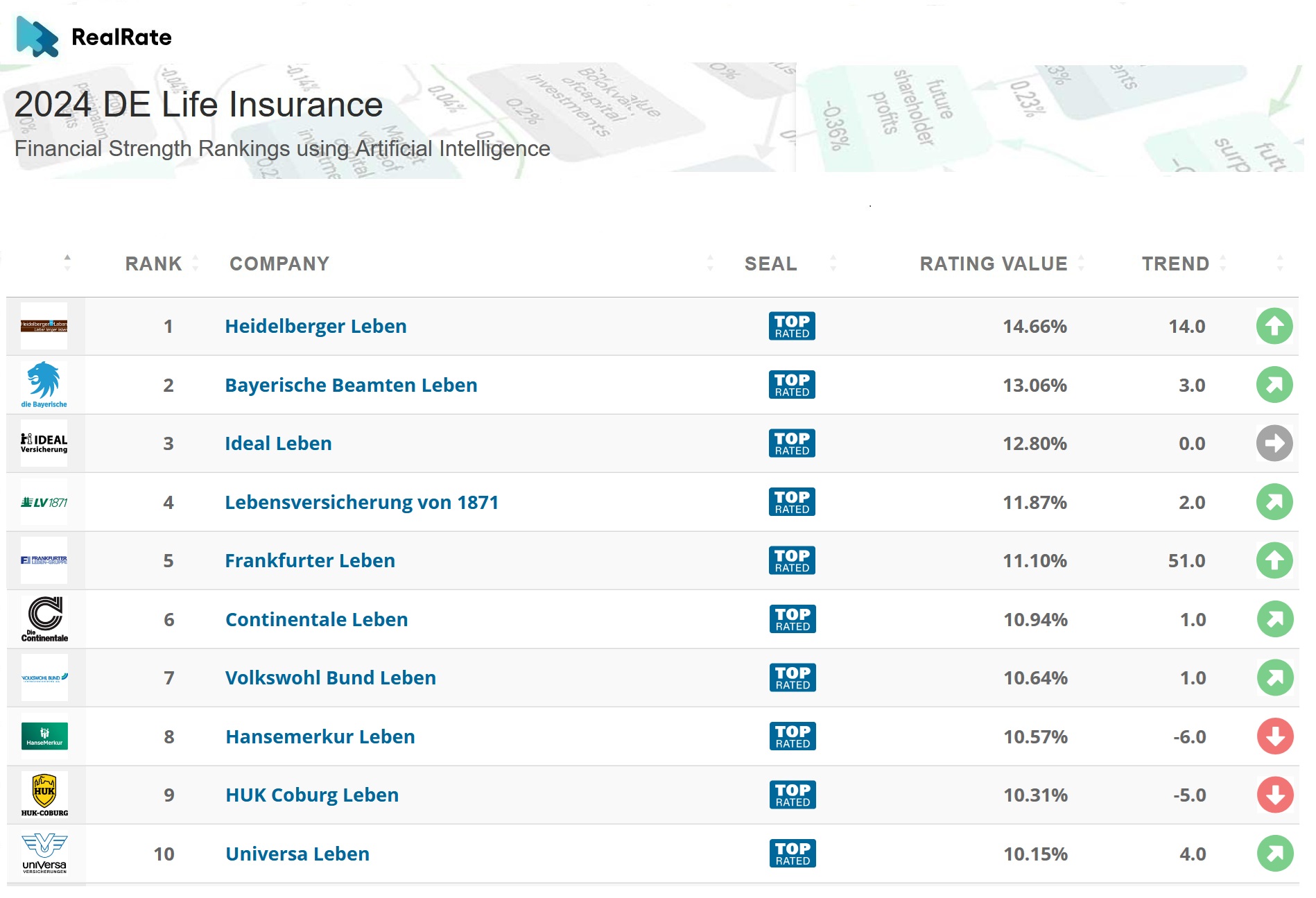

The top 10 German life insurance companies are:

Source: https://realrate.ai/rankings/

Heidelberger Lebensversicherung takes first place in the RealRate ranking of the strongest German life insurers for the first time. Its economic equity ratio is 14.7%. Bayerische Beamten Lebensversicherung follows in second place with an economic equity ratio of 13.1%, which has improved significantly in recent years. Ideal Lebensversicherung took third place on the winners‘ podium with an economic equity ratio of 12.8%.

The ranking is based on the financial strength of the companies. This is particularly important for life insurers, as the future profit participation of customers depends on it. The economic equity ratio (economic equity in relation to the balance sheet total) serves as a benchmark. A total of 59 German life insurance companies were examined.

Heidelberger Lebensversicherung has only been included in the ranking for two years. Heidelberger Lebensversicherung AG discontinued new business in 2014 and, as part of the Viridium Group, has since concentrated exclusively on winding up its portfolio. In this respect, it is a special case.

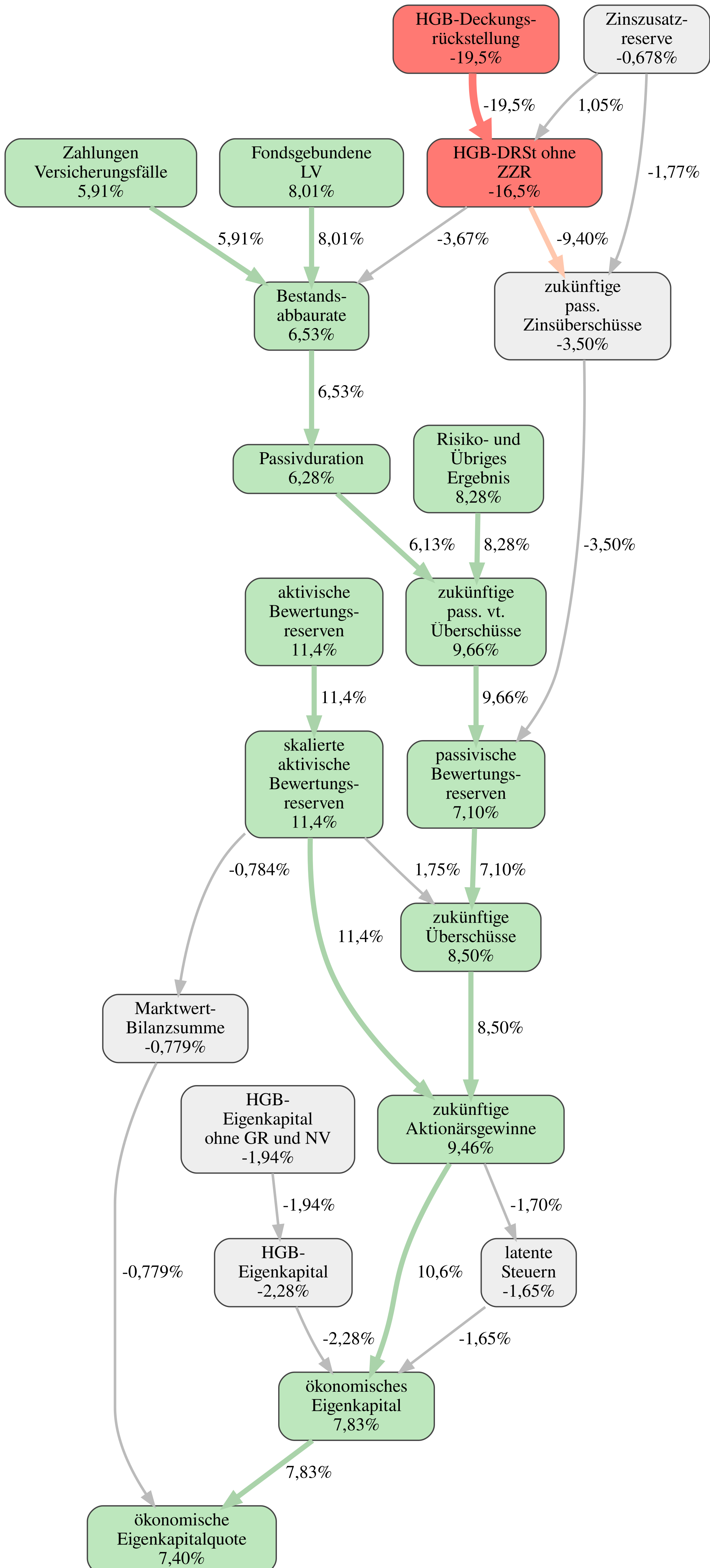

Heidelberger Lebensversicherung has three strengths. Firstly, measured against the size of the company, it has relatively low hidden burdens, whereas the market as a whole has built up considerable hidden burdens on average due to the high investment duration and the recent sharp rise in interest rates. Hidden burdens mean that the market values of the bonds are below the carrying amounts in the balance sheet. Secondly, Heidelberger has very high underwriting profitability, which will also lead to high profits in the future. And thirdly, it has a high portfolio stability, so that future profits can be realized.

Causal Tree financial strength rating winner 2024: Heidelberger Lebensversicherung:

Source: https://www.realrate-archive.com/de_life_insurance/2023/report/DL1158_2024_Heidelberger_Leben.pdf

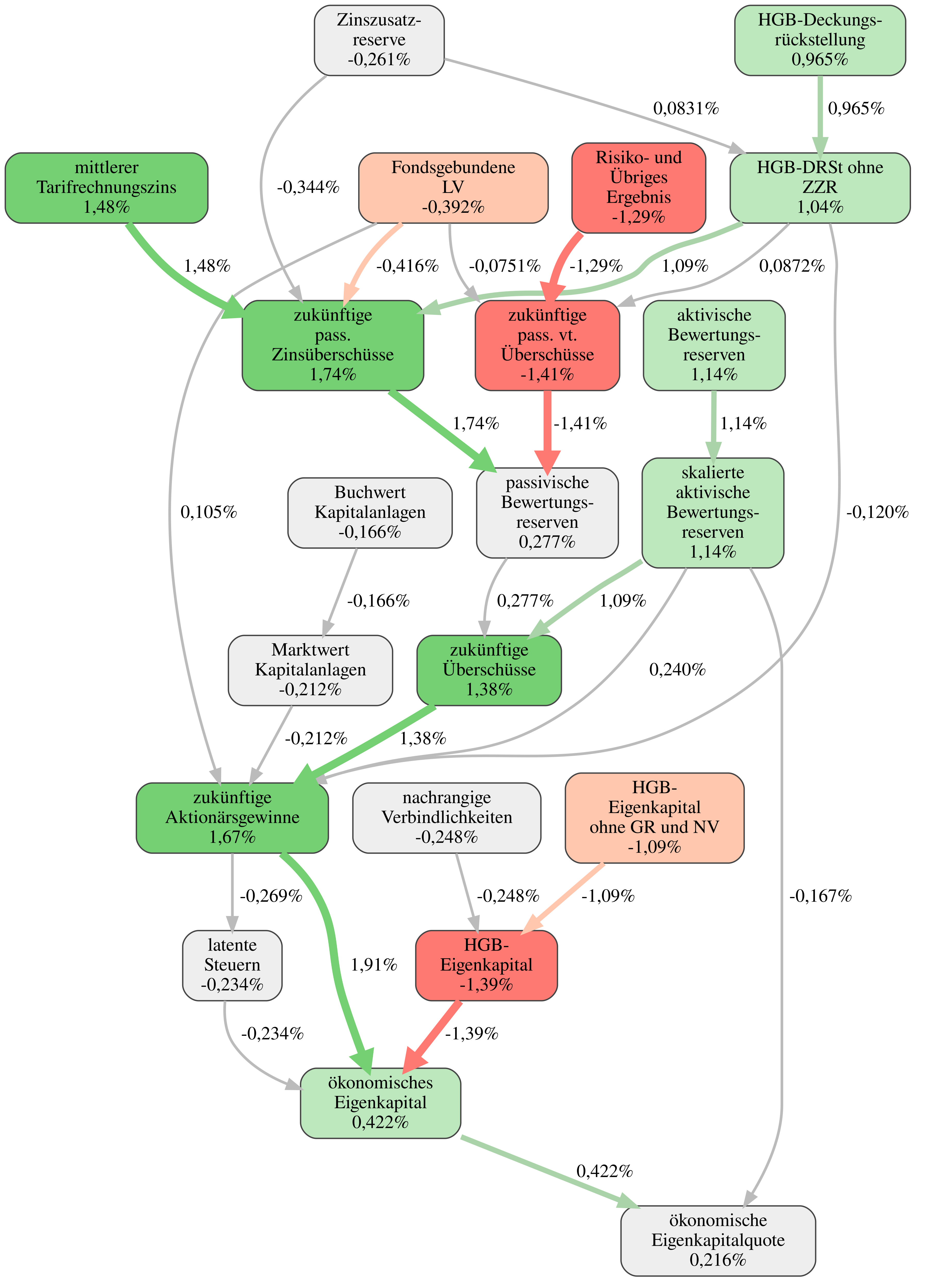

The market leader in terms of size, Allianz, has an economic equity ratio of 7.5%, which is slightly above the market average. A very differentiated picture emerges here, particularly on the liabilities side. On the one hand, high interest gains can be expected, as the average guaranteed interest rate of 1.9% is well below the industry average of 2.6%. However, this strength is largely offset by a below-average risk and other result. The products therefore have an above-average interest margin but a below-average risk margin.

Causal tree financial strength market leader: Allianz Lebensversicherung:

Source: https://www.realrate-archive.com/de_life_insurance/2023/report/DL1006_2024_Allianz_Leben.pdf

Three parameters are central to high financial strength: firstly, the valuation reserves on the assets side, secondly the HGB equity and thirdly the underwriting profitability in the form of the risk result and other result. The average guaranteed actuarial interest rate also plays an important role.

The RealRate valuation model does not work with fixed weightings but determines the fair economic value of the company using a holistic valuation approach. As the causality diagram shows, the numerous pieces of information from the balance sheet and income statement are gradually combined to form a company value, the economic equity.

You can find the complete ranking at:

https://realrate.ai/ranking-area/2024-de-life-insurance/

The methodology used is described in “Explainable artificial intelligence using the example of ratings of German life insurance companies”,

https://elibrary.duncker-humblot.com/article/70819/erklarbare-kunstliche-intelligenz-am-beispiel-von-ratings-deutscher-lebensversicherungsunternehmen.