RealRate’s advantage – Pillars of success

With many years of expertise in data analysis, expert consulting, and financial health evaluation via explainable financial AI, RealRate can help you reveal your weaknesses and help you improve your operational performance.

Who It’s For:

Perfect for businesses aiming to:

Gain financial growth and stability.

Optimize operational processes.

Gain a competitive advantage in the market.

Award-Winning Innovation

- Top AI Startup in Finance & Insurance – AppliedAI Initiative

- Winner – PyTorch Hackathon (Responsible AI Category)

- Top 25 Insurtech CEOs – Technology Innovators Magazine

- Most Innovative AI Ratings Provider – EU Business News

At RealRate Consulting, we combine the power of explainable AI with expert knowledge to help companies gain a clear, objective understanding of their true economic position.

Our consulting services are designed to enhance strategic decision-making, improve financial transparency, and strengthen stakeholder trust.

Whether you’re refining your operational system or navigating complex financial challenges, our team provides tailored, actionable insights backed by our industry-leading Explainable AI.

Due to insufficient insights and macro-economic factors, many companies are facing with several challenges.

Specific Pain Points & Our Solutions:

Cash Flow Volatility

Many companies face unstable cash flow due to inaccurate revenue forecasting, inconsistent expense tracking, and poor liquidity planning.

Risk & Financial Analysis

We identify cash flow gaps, assess liquidity ratios, and map out a plan to stabilize your financial runway—without locking you into long- term contracts.

Operational Bottlenecks

Manual processes, disjointed systems, and lack of KPI tracking often lead to missed deadlines and wasted resources.

Consulting Workshops

Tailored sessions to streamline your workflows, introduce automation tools, and train your team to monitor performance metrics that truly matter.

Low Creditworthiness & Customer Distrust

Poor financial transparency and weak balance sheet ratios can hurt your ability to win contracts, secure loans, or retain customers.

Credit Risk Assessment

We evaluate your debt levels, solvency ratios, and reporting clarity to boost your credit profile and build trust with clients and investors.

Why RealRate?

- Actionable Reports: Turn financial data into clear next steps

- Real-Time Insights: Say goodbye to guesswork

- Risk Prevention: Stay ahead of disruptions before they hit

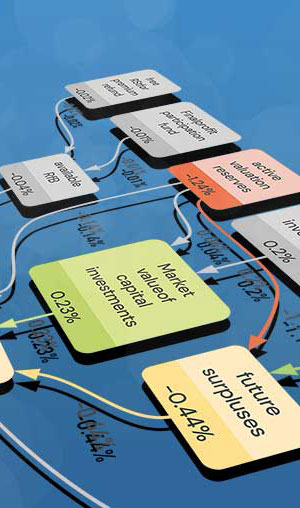

- Explainable AI: Understand “why” with our transparent causal graphs

Start 2025 with Confidence.

Get objective, AI-powered insights to improve decision-making, strengthen financial health, and outperform your competition.

Dr. Holger Bartel,

the founder and CEO of RealRate. RealRate is the first AI rating agency. We use our award-winning AI tool to produce transparent and explainable financial strength ratings. We cover more than 20 US industries and over 2,000 publicly traded companies. We are innovative, unbiased, and independent. We stand for transparency, reliability and fairness. We are here to help you gain financial stability and growth.

Connect on Linkedin