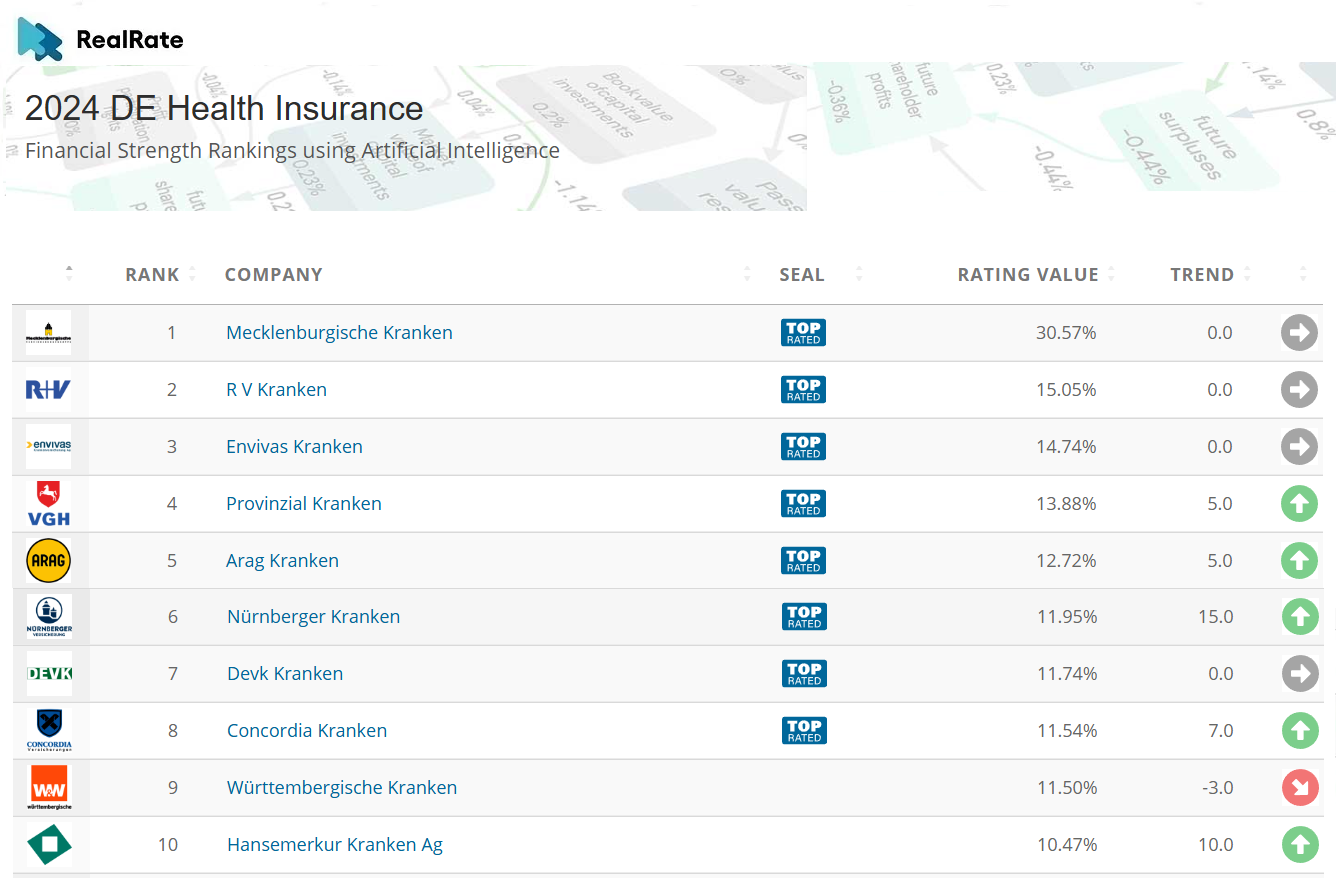

The Top 10 German Health Insurance companies are as follows:

Source: https://realrate.ai/rankings/

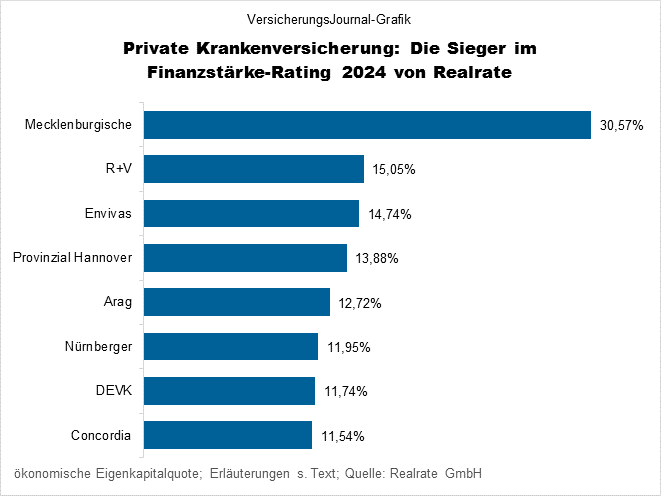

For the second time in a row, Mecklenburgische Kranken is ranked first in the rankings. In previous years, it was ranked fourth and second, so a steady improvement can be seen. With an economic equity ratio (economic equity in relation to total assets) of 30.57%, it is well ahead of the runner-up, R+V Kranken (economic equity ratio 15.05%). Third place on the winners’ podium once again goes to ENVIVAS Kranken (economic equity ratio 14.74%).

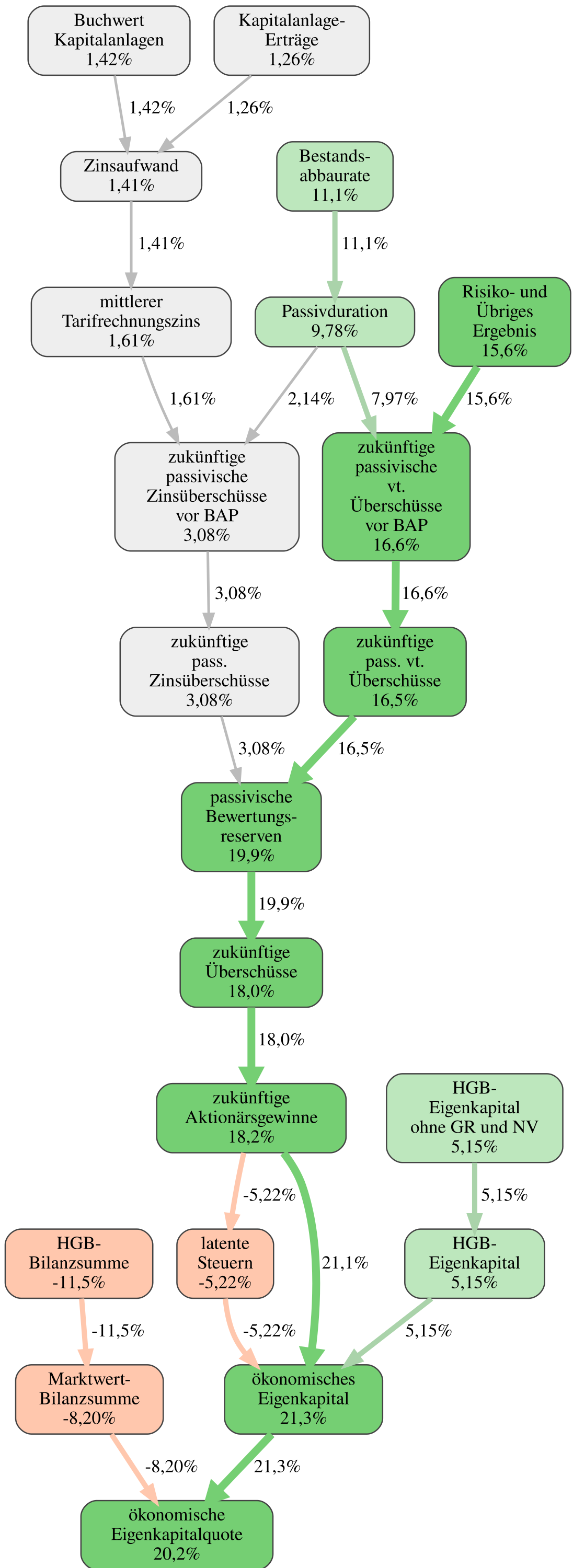

For its size, Mecklenburgische Kranken has the strongest risk and other result on the market. The products therefore have an extraordinarily high technical profitability. In conjunction with the high stability of the portfolio (low portfolio departures), this leads to high expected surpluses. Policyholders also benefit from this through profit participation. The core business is in excellent health and high profits can be expected in the future. This strengthens Mecklenburgische’s financial strength. The only downside is the above-average expenditure on capital investments. This could be due to depreciation.

2024 DE Health Mecklenburgische Kranken – graph 1 – top 1:

This year, too, the observation that size alone does not equate to great financial strength has been confirmed. Numerous industry giants are below the market average: Generali (18th place), AXA (29th place), ERGO (30th place), Allianz (second to last place 31), DKV (last place 32).

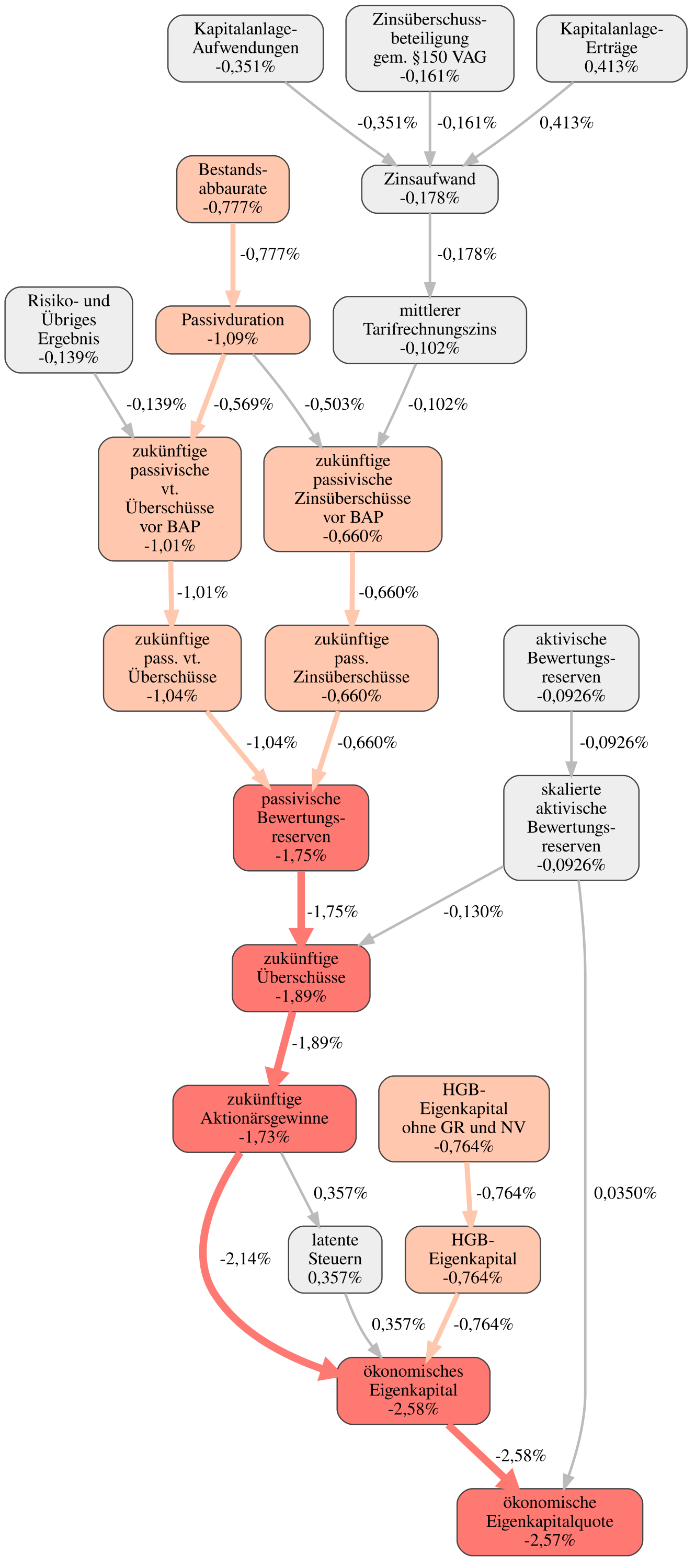

The market leader Debeka is in 28th place out of 32 health insurers. Its economic equity ratio is 7.78 percent. Although Debeka has above-average and continuing to rise investment returns, the future surpluses expected have come under pressure in the last two years. This is also due to the fact that the stability of the portfolio is relatively low: while the market average is only 5.3% of insured people leaving the collective due to expiration or cancellation, at Debeka the figure is 7.9% per year. In addition, Debeka’s commercial law equity ratio is below the market average. This is typical for industry giants that enjoy the trust of policyholders even without a high level of equity. However, there is no bonus for company size alone in the RealRate valuation model. We look at the relative balance sheet structure and thus make large and small insurers comparable. In the health insurance rating in particular, it becomes clear that the smaller providers in particular have a favorable balance sheet structure.

2024 DE Health Debeka Kranken – graph 2 – big player:

A total of 32 German health insurers were analyzed and evaluated in terms of their financial strength. Two factors are central to high financial strength: firstly, the HGB equity and secondly, the underwriting profitability in the form of risk and other results. In addition, the stability of the company and the investment result also play an important role.

The RealRate valuation model does not work with fixed weights, but rather determines the fair economic company value using a holistic valuation approach. As shown in the graphic, the numerous pieces of information from the balance sheet and income statement are gradually combined to form a company value, the economic equity. The causal graphic shows in color and numbers which influencing factors contribute to the above-average performance of the health insurer.

The complete ranking is available at:

https://realrate.ai/ranking-area/2024-de-health-insurance/

The methodology used is described in “Explainable Artificial Intelligence using the example of ratings of German life insurance companies.”

https://elibrary.duncker-humblot.com/article/70819/erklarbare-kunstliche-intelligenz-am-beispiel-von-ratings-deutscher-lebensversicherungsunternehmen

The insurance journal also currently reports on this ranking:

“These private health insurers are particularly financially strong”

https://www.versicherungsjournal.de/versicherungen-und-finanzen/diese-privaten-krankenversicherer-sind-besonders-finanzstark-151915.php

realrate.ai — Explainable Financial AI