Source: https://openai.com/dall-e-3/

The results for RealRate’s 2024 ranking for the German Disability Insurance industry are in and are ranked by technical future interest rate!

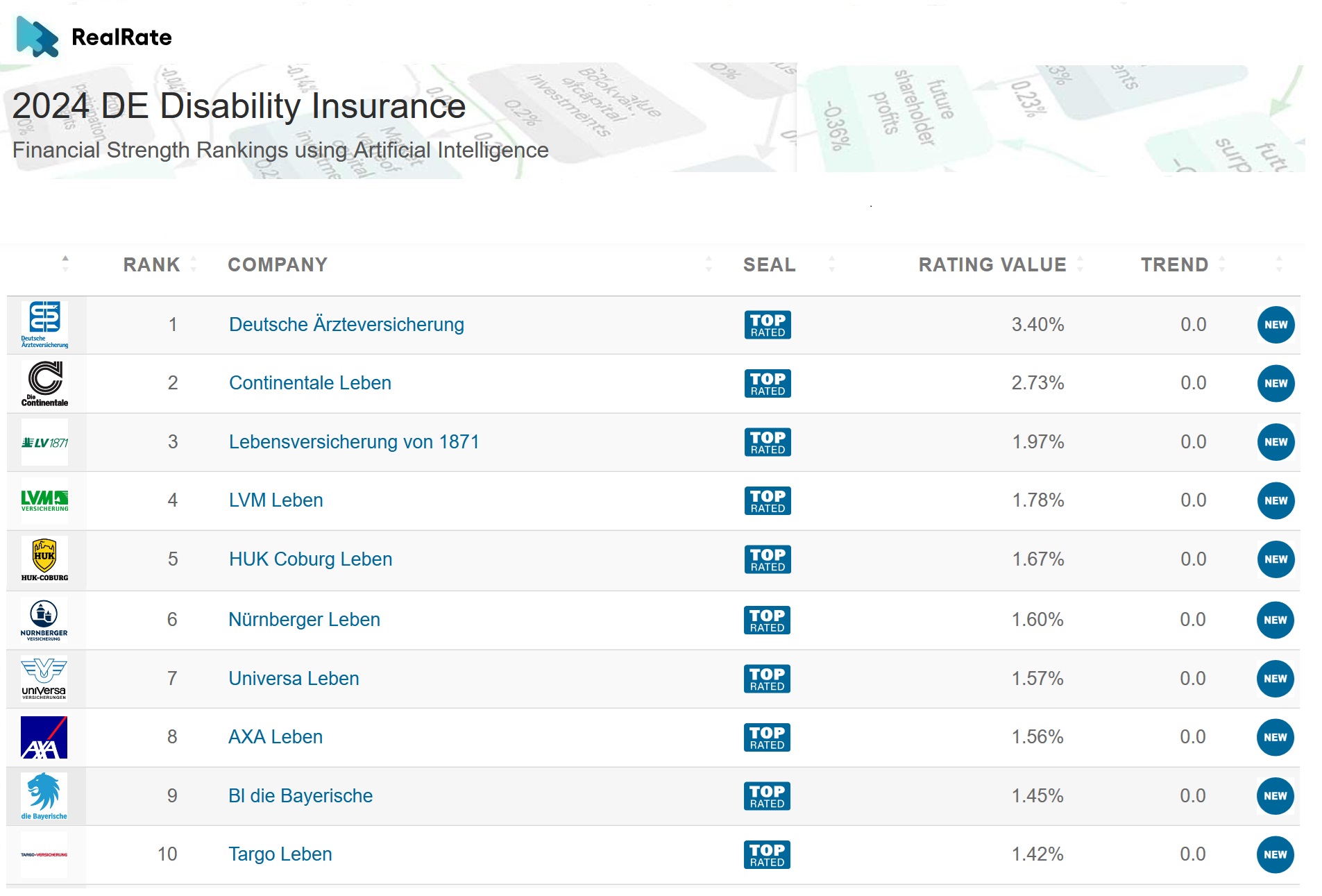

The Top 10 Disability Insurance companies are as follows:

Source: https://realrate.ai/rankings/

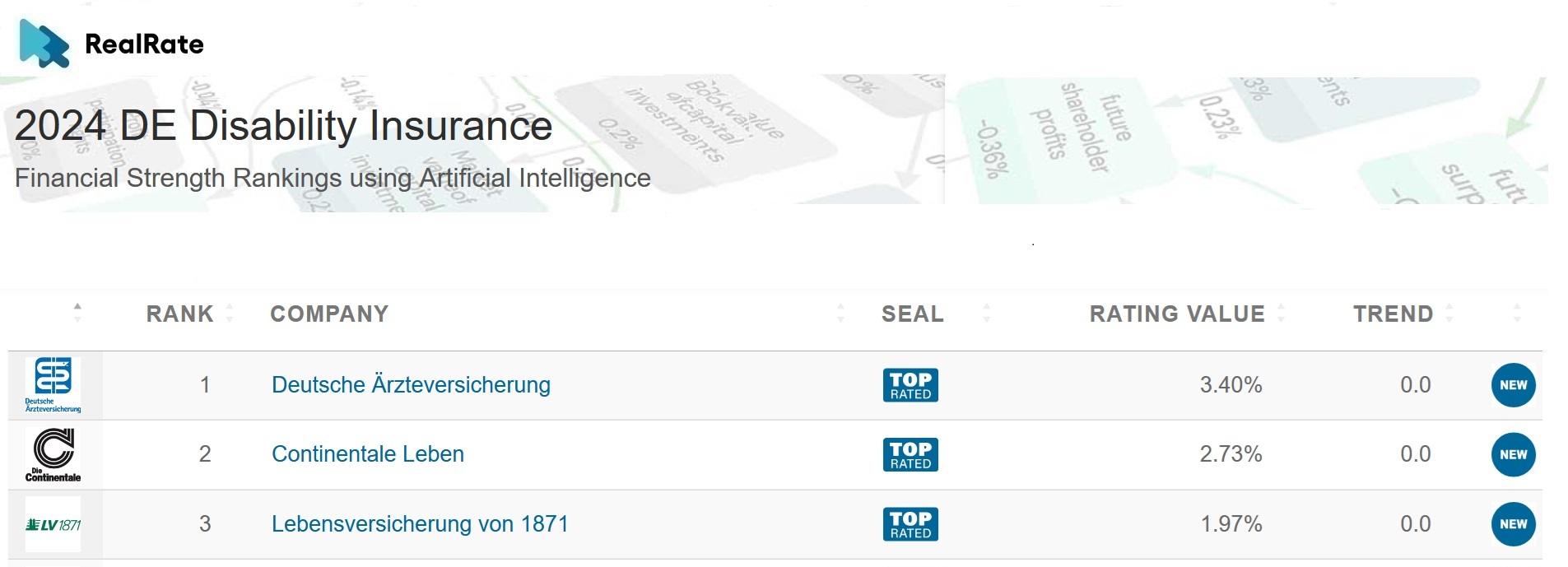

The top 3 Disability Insurance companies in order are Deutsche Ärzteversicherung, Continentale Lebenversicherung, and Lebensversicherung von 1871.

They had Economic Capital Ratio figures of 3.4%, 2.7%, and 2%, respectively.

Deutsche Ärzteversicherung did well due to its strong Risk and Other Result score, and Continentale Lebenversicherung and Lebensversicherung von 1871 did well due to their strong Hidden Reserves on Liabilities scores. These increased the companies’ Economic Capital Ratio scores by 2.5, 1.8, 0.97 percentage points, respectively.

Deutsche Ärzteversicherung retain its 1st position from last year, Continentale Lebenversicherung move up 2 spots, and Lebensversicherung von 1871 moves up 5 spots. Congratulations to all 3 companies!

From a total of 58 Disability Insurance companies, 14 received our sought after ‘Top-Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-3/

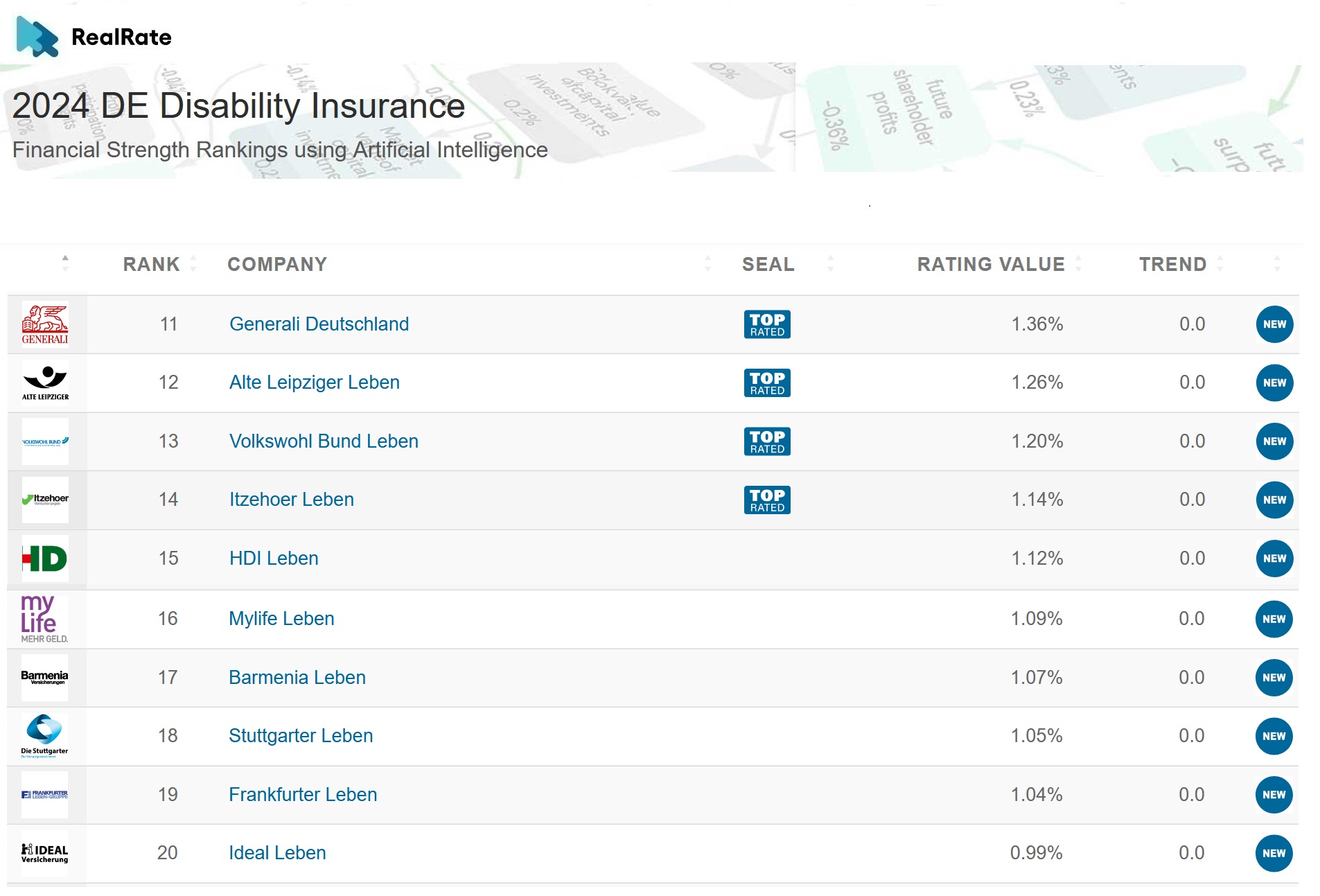

The next 10 Disability Insurance companies are as follows:

Source: https://openai.com/dall-e-3/

Disability insurance in Germany is one that replaces part of your monthly income in case a disability arises which means you cannot work.

The sector plays a crucial role in protecting individuals against income loss due to health issues or accidents that impede their ability to work.

There are many types of policies that differ in cost and overall coverage, but it is usually about 1-3% of your annual salary.

Over 8 million people in Germany currently have such a policy. Term-life and disability insurance will only pay out in the event of death or disability, respectively.

In 2024, the disability insurance market in Germany grew to an estimated $5.03 billion and is forecasted to expand at a compound annual growth rate (CAGR) of 11.53%, reaching $9.83 billion by 2030.

The Top-Rated insurance companies will be able to maintain high bonus participation in the future.

RealRate brings to the market fair and independent company ratings, coupling expert knowledge with revolutionary artificial intelligence. Our AI model processes the all-important technical future interest rate figure.

We are completely unbiased and are not connected to any insurance company. We are and always will be fair and explainable.

We are RealRate, bringing to the world a brand-new way to see ratings.