HUK-COBURG Leben takes first place in the ranking for the fourth time in a row. Second place goes to Bayerische Beamten Leben, which improved by one place compared to the previous year. Helvetia Leben takes third place. The ranking is based on the financial strength of the companies. This is particularly important for life insurers, as future profit participation depends on it. The economic equity ratio (economic equity to balance sheet total) serves as a benchmark. The top three companies are close together with economic equity ratios of 12.78%, 12.34% and 11.74%. A total of 59 German life insurers were analyzed.

The strong improvement of Helvetia Life, which was only ranked 49th in the previous year, is striking. Compared to the previous year, the risk and other result has improved significantly. On the other hand, the relative market positioning regarding the valuation reserves on the assets side has improved. Although these have fallen significantly in the market due to the rise in interest rates, they have fallen considerably less at Helvetia.

The market leader in terms of size, Allianz, is in the middle of the field with an economic equity ratio of 6.11%. Concordia oeco Leben, which had already performed very poorly in recent years, came in a distant last place. It is the only German life insurer with a negative economic equity ratio.

Three parameters are central to high financial strength: firstly, the valuation reserves on the assets side, secondly, the HGB equity and thirdly, the underwriting profitability in the form of the risk and other result. The average guaranteed actuarial interest rate also plays a key role.

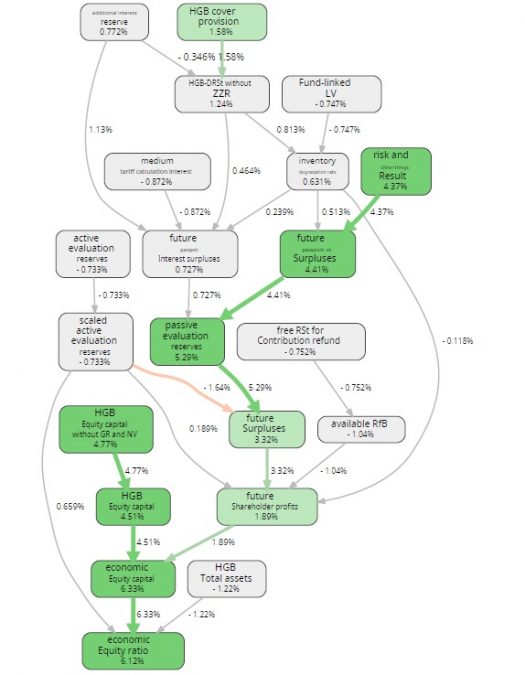

The RealRate valuation model does not work with fixed weightings but determines the fair economic enterprise value using a holistic valuation approach. As the causal graph of the winner HUK-Coburg Leben shows, the numerous pieces of information from the balance sheet and income statement are combined step by step until they lead to the company value, the economic equity.

The strength of HUK-Coburg Life begins with the strong risk and other result. This leads to high future surpluses and thus also to high shareholder profits. In addition, HUK-Coburg Leben has exceptionally high equity in relation to total assets. The greatest strength of HUK-Coburg Leben compared to the market average is the total valuation reserves on the liabilities side, which increase the economic equity ratio by 5.3 percentage points. This competitive advantage has improved even further compared to last year. The only notable weakness, the high average guaranteed interest rate, is therefore hardly significant. The economic equity ratio is 13%, which is 6.1 percentage points above the market average of 6.7%.

The complete ranking is available at: https://realrate.ai/ranking-area/2023-life-insurance/

The methodology used is described in „Erklärbare Künstliche Intelligenz am Beispiel von Ratings deutscher Lebensversicherungsunternehmen“, https://elibrary.duncker-humblot.com/article/70819/erklarbare-kunstliche-intelligenz-am-beispiel-von-ratings-deutscher-lebensversicherungsunternehmen

This rating was also reported on in the Versicherungsjournal: https://www.versicherungsjournal.de/markt-und-politik/diese-lebensversicherer-sind-besonders-finanzstark-149144