RealRate has computed the figures and is proud to present the best Risk Insurance companies in Germany for 2022, using its amazing artificial intelligence.

The results, sorted by financial strength, can be seen here.

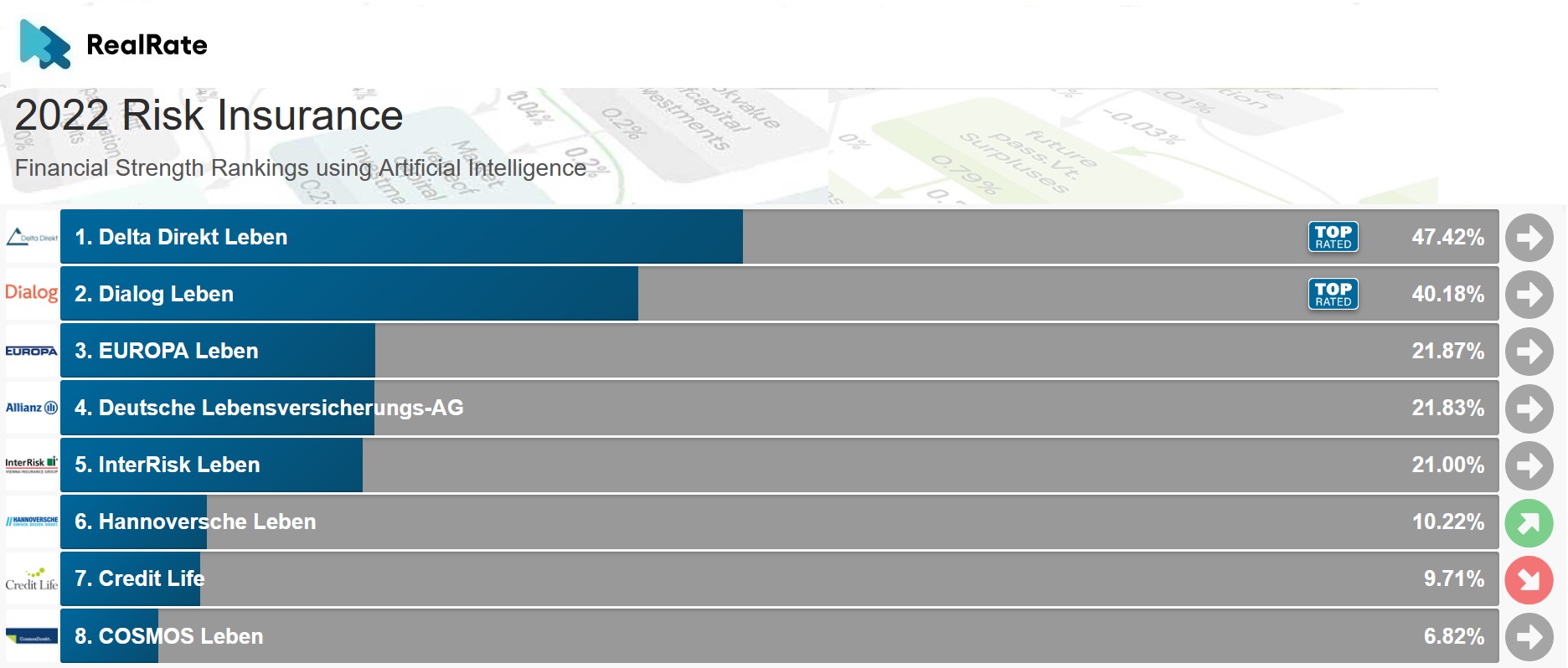

The Top 8 Risk Insurance companies are as follows:

Source: https://realrate.ai/rankings/

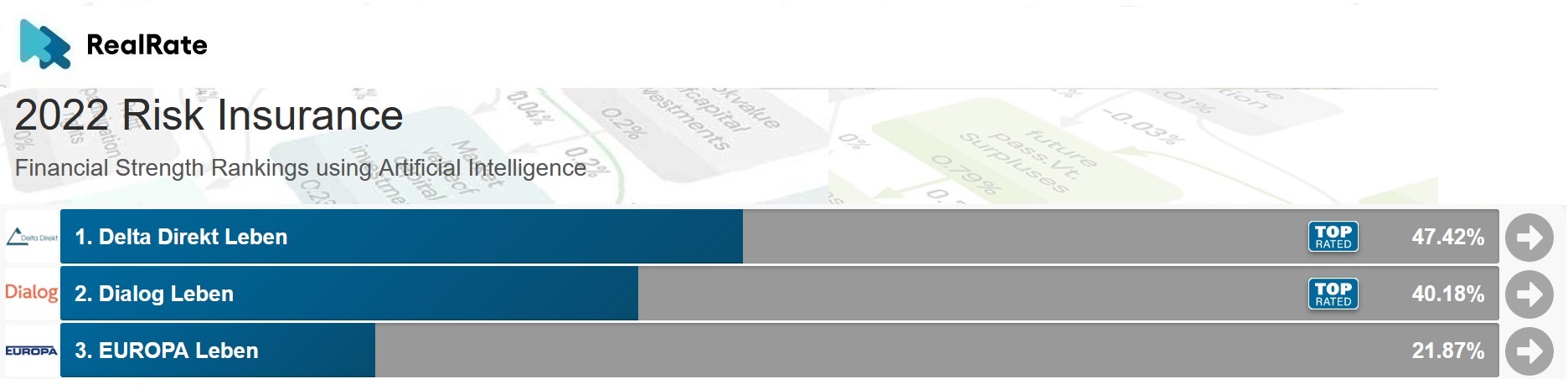

The top 3 companies in order are Delta Direkt Leben, Dialog Leben and Europa Leben. They have Economic Capital Ratio figures of 47%, 40% and 22% respectively.

They performed better than the rest due to their Future Shareholder Profit, Risk and Other Result and Churn Rate respectively.

Delta Direkt Leben and Dialog Leben retain their 1st and 2nd spots from 2021 and Europa Leben moves up from 4th.

Just 2 companies received our ‘Top Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-2/

The main difference between risk life insurance and traditional life insurance is when a payment is made. Risk life insurance will only pay out in the event of death, whereas traditional life insurance also pays in the event of survival.

Risk life insurance is also significantly cheaper than classic life insurance.

There are currently around 8 million active term life insurance policies and over €4 billion in annual premiums are paid.

The amazing thing we do at RealRate is to deliver fair and independent ratings, joining expert knowledge and cutting-edge artificial intelligence in a nice clear package. It’s our AI model that computes the all-important Economic Capital Ratio figure.

We are completely unbiased and use only audited public data. We are fair and explainable and avoid any conflicts of interest.

We are revolutionising the rating industry one rating at a time.

Main photo source: https://openai.com/dall-e-2/