We take a look at the brand new 2022 German life insurance ranking to see the new results in this important area.

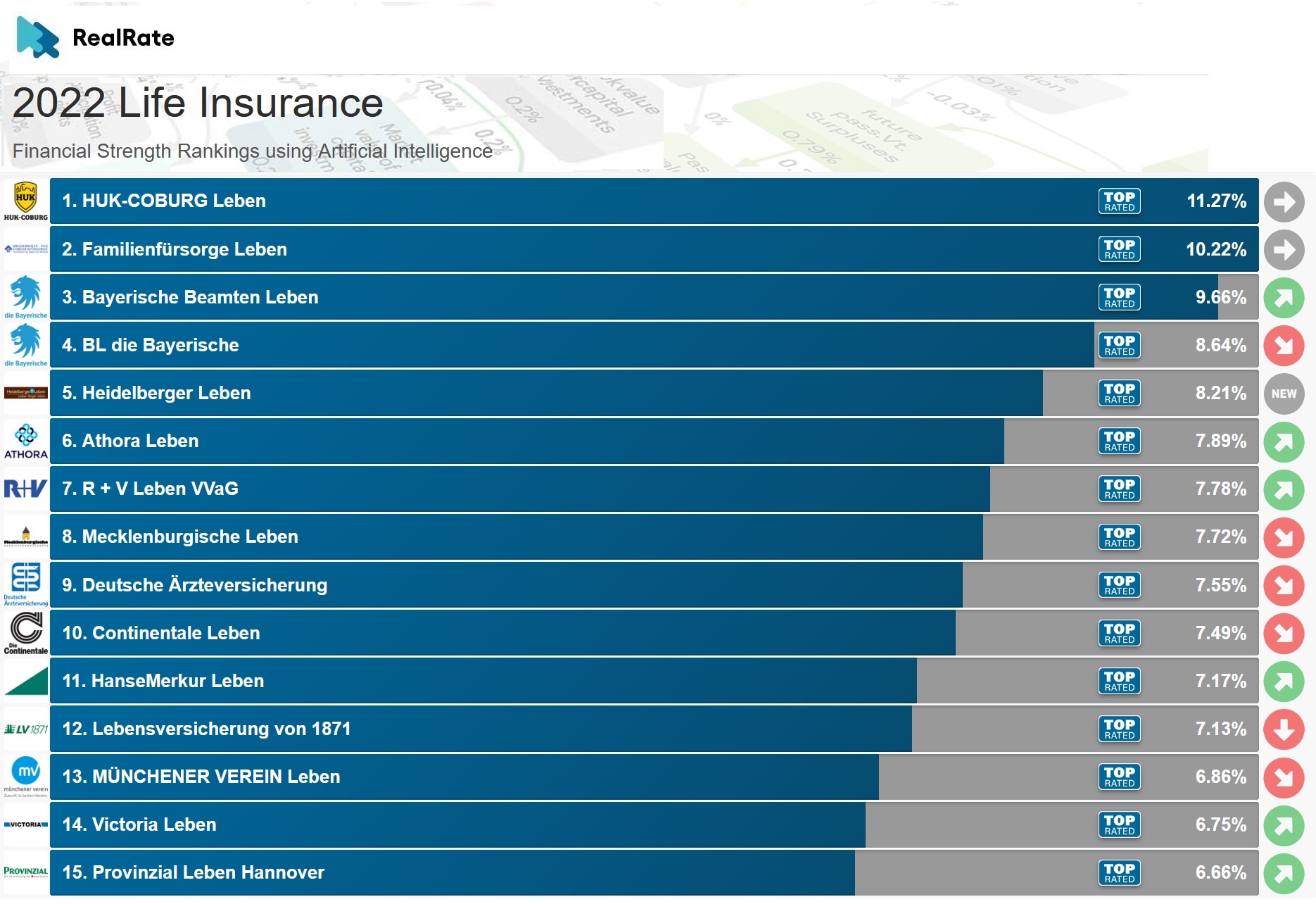

RealRate’s ranking of the top 15 German Life insurers for 2022 is below, with all achieving the prestigious “Top Rated” award.

Source: https://realrate.ai/rankings/

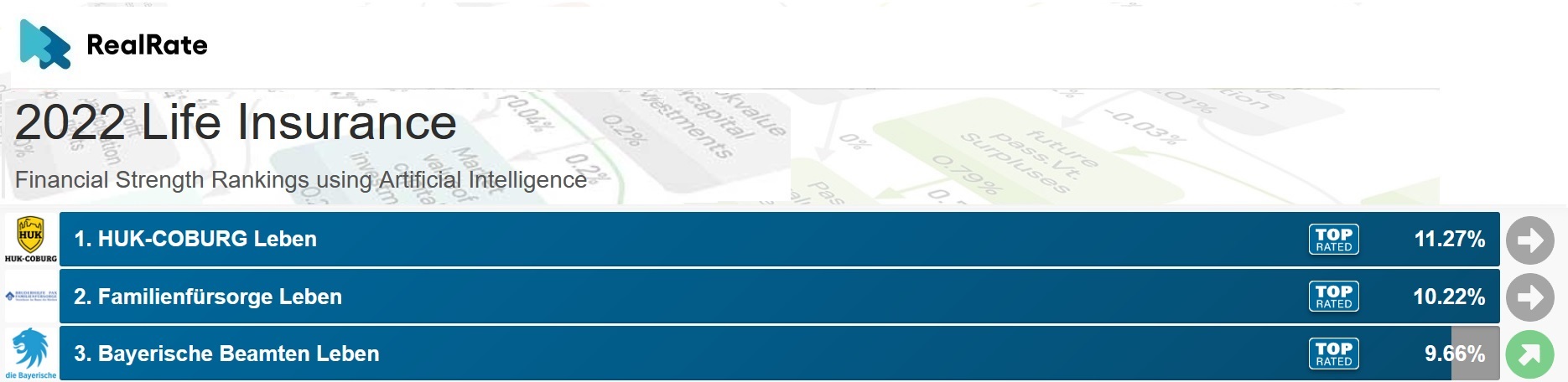

The top 3 companies are HUK-Coburg, Familienfürsorge and Bayerische Beamten.

They had Economic Capital Ratio figures of 11.27%, 10.22% and 9.66% respectively. The market average is 8.9%.

HUK-Coburg and Familienfürsorge did well due to their HGB capital without GR and NV figures, and Bayerische Beamten did well due to their strong HGB capital figure.

Source: https://realrate.ai/rankings/

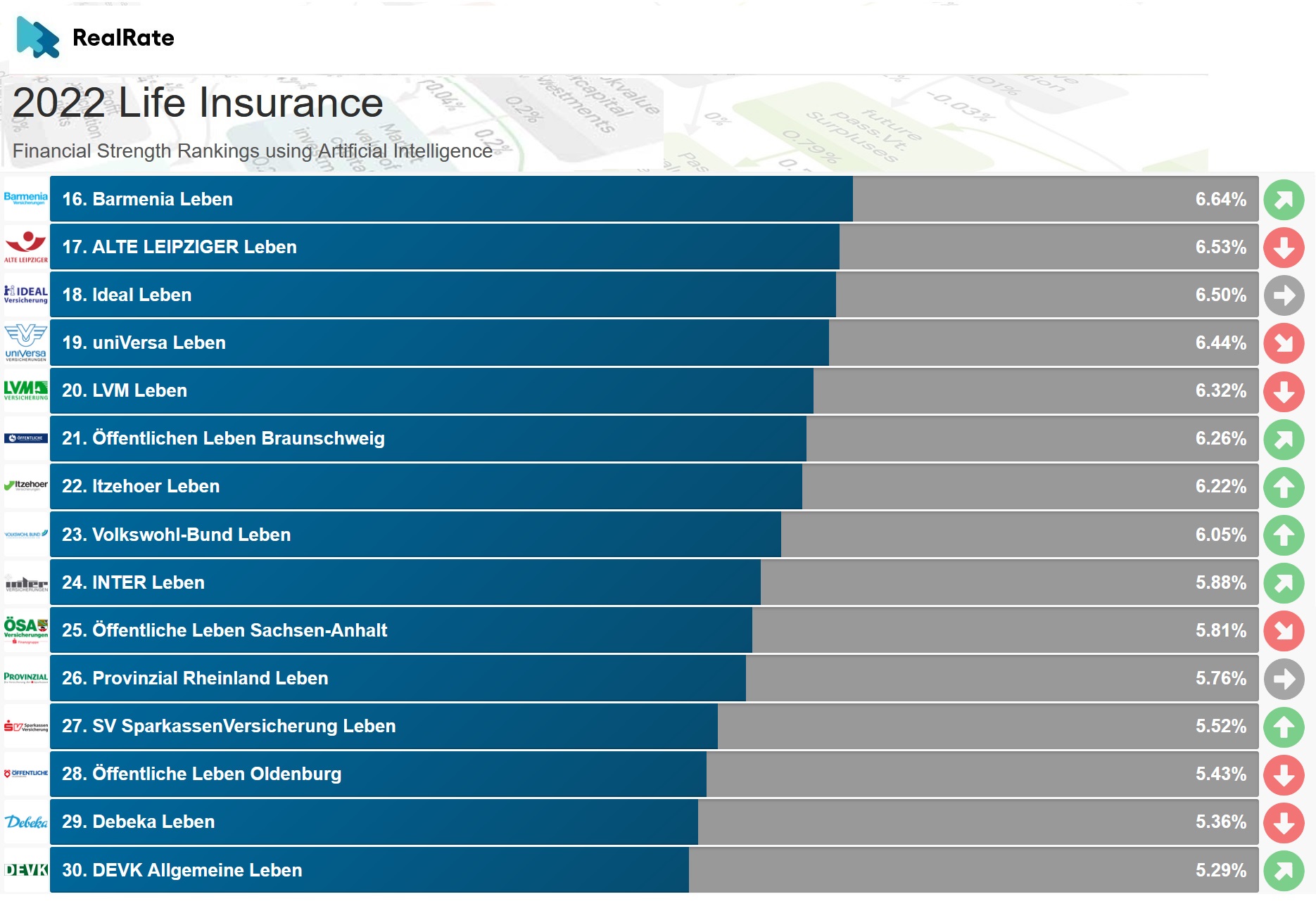

Here are the next 15 contestants:

Source: https://realrate.ai/rankings/

SV SparkassenVersicherung Leben climbed 15 positions from 42 to 27 due to its excellent Average Rate Calculation Interest.

WWK Leben lost 27 positions from 33 to 60 due to its poor Future Surplus score. Heidelberger Leben entered the 2022 ranking in 5th place, making it the best newcomer.

The biggest company by assets, Allianz Leben, is only in 38th place, whereas the smallest company, Itzehoer Leben, is financially stronger in 22nd.

Source: https://realrate.ai/rankings

The German life insurance market is worth over €100 billion with over 30 million active policies.

The brilliant thing about RealRate is that we deliver 100% fair and independent ratings, joining together expert knowledge and cutting edge artificial intelligence.

The AI model that we use computes the super important Economic Capital Ratio figure.

It’s totally unbiased and uses only audited public data. We are not only fair and explainable but avoid any conflicts of interest, too.

We’re very excited about the future of the rankings industry.

Main photo source: https://openai.com/dall-e-2/