Source: https://openai.com/dall-e-2/

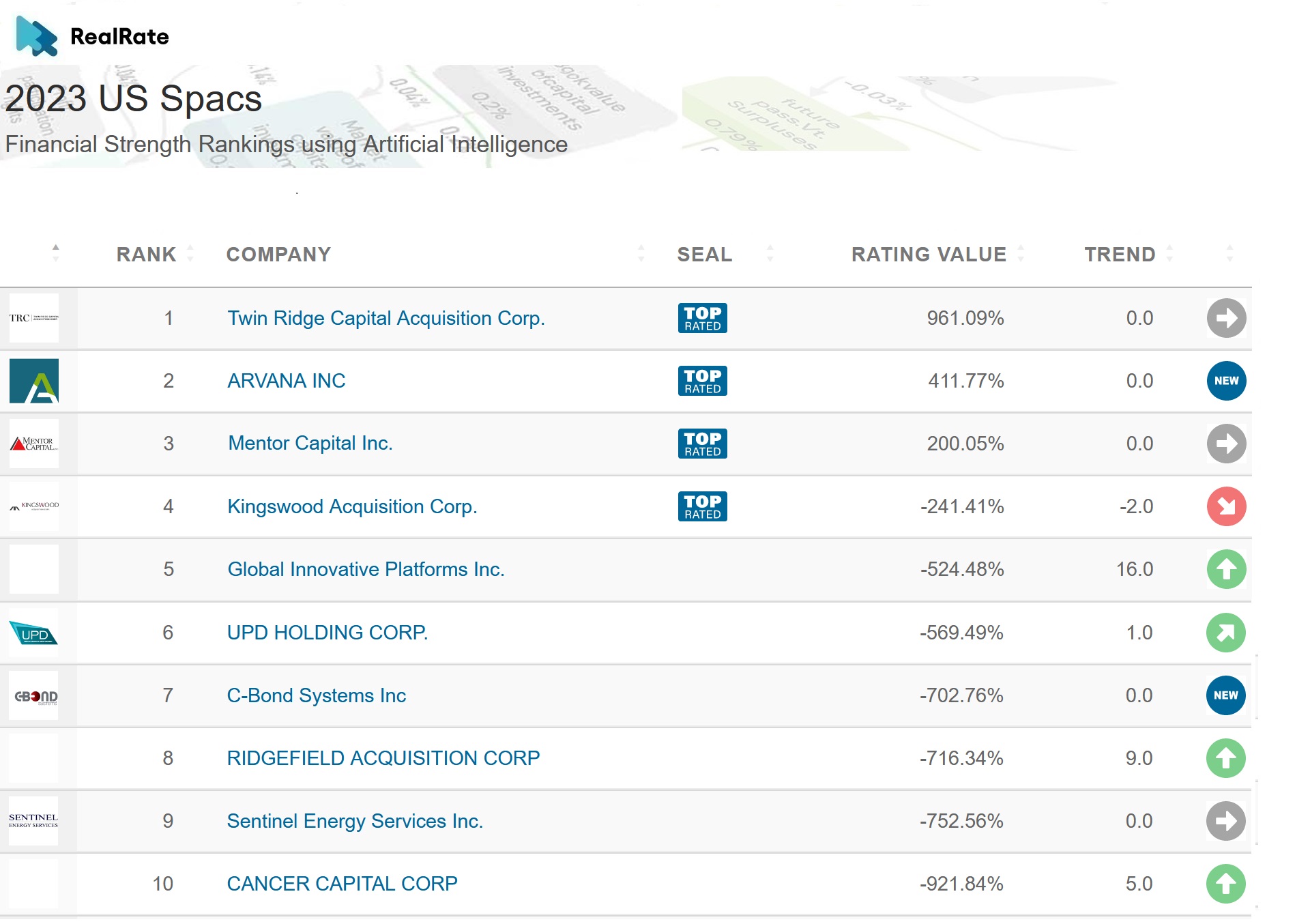

The results for RealRate’s 2023 ranking for U.S. Spacs are now in and ranked by financial strength!

The Top 10 Spacs are as follows:

Source: https://realrate.ai/rankings/

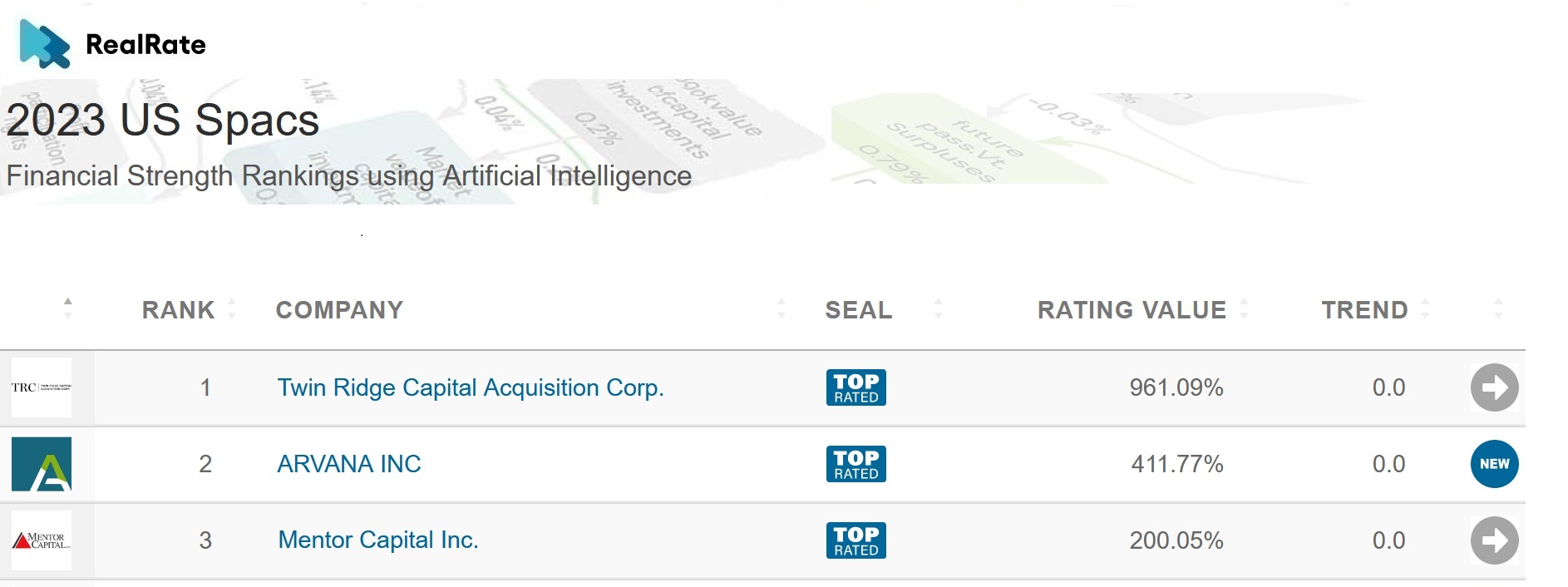

The top 3 Spacs in order are Twin Ridge Capital Acquisition Corp., Arvana Inc., and Mentor Capital Inc.

They had Economic Capital Ratio figures of 961%, 412%, and 200%, respectively.

Twin Ridge Capital Acquisition and Mentor Capital did well due to a strong Current Liabilities variable. This increased the companies’ Economic Capital Ratio scores by 687% and 733%, respectively. Arvana had a strong Other Assets variable which increased its Economic Capital Ratio score by 756%.

Twin Ridge Capital Acquisition was 1st last year, Arvana didn’t make the list last year (but was 15th in 2021) and Mentor consolidated its 3rd place.

From a total of 18 Spacs, 4 received our ‘Top Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-2/

A special purpose acquisition company (SPAC) is a publicly traded company created to acquire or merge with an existing company.

U.S. SPACs raise billions of dollars, fueling investments in various industries like tech, healthcare, and EVs. SPAC IPOs surged in 2021, hitting record highs, with over $160 billion raised. Specific revenue figures vary widely among individual SPACs.

The impressive thing we do at RealRate is to deliver utterly fair and independent company ratings, bringing together expert knowledge and innovative artificial intelligence in one package. Our AI model computes the all-important Economic Capital Ratio figure.

Looking at our model in more detail, one can see it is very much unbiased and only uses audited public data.

We are fair, explain ourselves very well, and we also avoid any all-important conflicts of interest.

https://realrate.ai – The first AI rating agency