These life insurers are particularly financially strong.

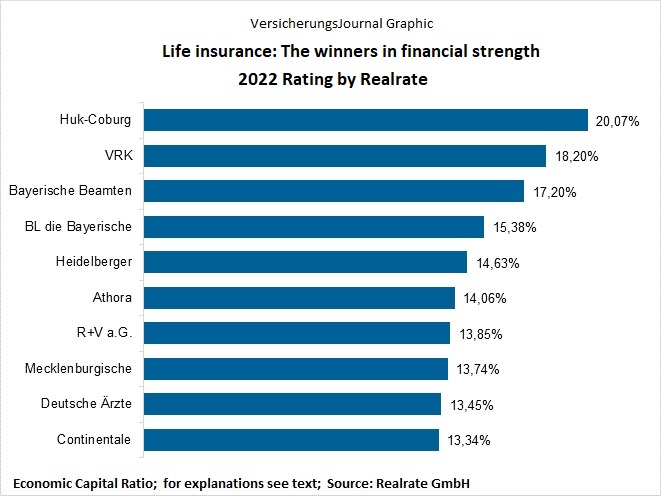

Huk-Coburg and VRK have the highest Economic Capital Ratios among German life insurers. This is the conclusion reached by RealRate in its financial strength rating.

RealRate GmbH recently presented the current edition of its financial strength rating of German life insurers. The rating positions are assigned according to the so-called Economic Capital Ratio.

Economic Capital Ratio

The Economic Capital Ratio is the ratio of Economic capital to total assets. „Economic capital comprises, on the one hand, past profits that have been saved in equity under commercial law and, on the other hand, future profits from the portfolio,“ explains Managing Director Holger Bartel when asked by the editorial team.

„In the process, a revaluation from book to market values takes place; in other words, the hidden reserves resulting from the difference between book and market values are taken into account. In terms of methodology, the numerator of the economic capital ratio thus essentially corresponds to the numerator of the regulatory Solvency II ratio,“ Bartel explains further.

Further details on the methodology

The analyst describes the selected valuation model as „a hybrid system: On the one hand, it consists of an expert system. On the one hand, it consists of an expert system, which gradually combines the publicly available input data from the balance sheet in accordance with commercial law using various ratios until it arrives at the Economic Capital Ratio that is ultimately relevant.“

In addition, artificial intelligence (AI) is used as a modern statistical method. This is done by robustly estimating key model parameters that determine the influence of equity and future profits on solvency across all companies and over several years.

According to Bartel, only a few free parameters are used in the process. As examples, the RealRate CEO cites a „scaling factor on past accumulated profits under commercial law or for the present value multiplier by which future profits are multiplied to arrive at the enterprise value.“

The parameters are estimated within the framework of supervised machine learning in such a way that the company value (according to the published Solvency II own funds) is as accurate as possible. Bartel points out: „Our model is intended to explain reality as well as possible. The more data you have, the better the estimate of the parameters.“ For the life insurers, this is the data over the last eight years.

Huk-Coburg with the highest rate

The analysis house scrutinized a total of 60 life insurers. The highest Economic Capital Ratio (20.1 percent) is shown for Huk-Coburg-Lebensversicherung AG. Behind it follow the insurers in the area of the churches life insurance AG (VRK; 18,2 per cent) and Bayerische Amts Lebensversicherung AG (17.2 percent).

BL die Bayerische Lebensversicherung AG, Heidelberger Lebensversicherung AG, Athora Lebensversicherung AG, R+V Lebensversicherung AG, Mecklenburgische Lebensversicherungs-AG, Deutsche Ärzteversicherung AG and Continentale Lebensversicherung AG have figures of between a good 15 and a good 13 percent.

These ten players received the „top rated“ seal, which is awarded to the best quarter of the test candidates. Also in this group are Hansemerkur Lebensversicherung AG, Lebensversicherung von 1871 a.G. München, Münchener Verein Lebensversicherung AG, Victoria Lebensversicherung AG and Provinzial Lebensversicherung Hannover.

Table and causal graph

The complete ranking can be viewed here:

https://realrate.ai/ranking-area/2022-life-insurance/

There, the analysts provide a two-page PDF rating report for each provider examined, which can be opened by clicking on the company name.

The document shows in tabular form how the respective company performs in relation to the variables that influence the Economic Capital Ratio. The strengths and weaknesses compared with the market average are also listed.

Secondly, a causal graph „clearly shows the relationship between the individual ratios. The strengths (green) and weaknesses (red) are highlighted in color,“ explains Bartel.

Background on Huk-Coburg

According to RealRate’s managing director, Huk-Coburg, VRK and Bayerische are not the market heavyweights on the podium. The three aforementioned companies have repeatedly achieved top rankings.

In the case of Huk-Coburg, the high level of equity under commercial law (excluding profit participation rights and subordinated liabilities) was the main reason for its very good financial position. As background, Bartel explains that the company received a comprehensive capital increase from the Group in the course of the Solvency II introduction.

„Compared to the market average, it increases the Economic Capital Ratio by 7.63 percentage points. But also the high product profitability (risk and other result) contributes a lot to the strengthening of the financial strength. It increases financial strength by 5.26 percentage points,“ explains Bartel.

Taking all effects into account, the Economic Capital Ratio of just under 20.1 percent is 11.2 percentage points above the average for all German life insurers of 8.9 percent.

Allianz in position 38: Strengths…

The market leader Allianz Lebensversicherungs-AG (VersicherungsJournal 16.8.2022) landed in 38th place with a slightly below-average rate of 8.23 percent. According to Bartel, Allianz’s greatest strength is „the low promised guaranteed interest rate (average tariff calculation interest rate), which is estimated indirectly from the available balance sheet data.

In the low-interest phase, Allianz started earlier than other insurers to reduce the burden of guaranteed interest rates by introducing complementary modern products with lower interest rate guarantees. This strategy has sustainably strengthened the company’s financial strength: the Economic Capital Ratio has risen by 4.63 percentage points compared to the market average.“

The market leader also has extensive valuation reserves on the assets side (the market values of the investments are higher than the conservatively recognized book values of the HGB balance sheet). As a result, the Economic Capital Ratio increased by 2.27 percentage points compared with the average for all life insurers.

„The actuarial interest rate and valuation reserves will be realized together in the form of future surpluses, which are recognized in the real-rate valuation model,“ explains Bartel on the background. This is also in line with the logic of the Solvency II supervisory regime.

…and weaknesses of the market leader

Bartel describes Allianz’s below-market risk and other result as a relative weakness. This corresponds to below-average underwriting product profitability, which reduces financial strength by 3.22 percentage points.

„Although Allianz Leben’s equity under commercial law (excluding profit participation rights and subordinated liabilities) of around three billion euros is huge in absolute terms, it is below market average compared with the balance sheet total of around 284 billion euros,“ the RealRate managing director added. This reduces the financial strength ratio by 2.26 percentage points.

In the RealRate rating model, according to Bartel, „there is no bonus for absolute size. Instead, the relative balance sheet structure is compared, in which size plays no role.“

Market sizes only in the midfield

The best performer among the market heavyweights with more than 2.5 billion euros in premium income is Alte Leipziger Lebensversicherung AG in 17th place. Like Allianz, Debeka Lebensversicherungs-Verein a.G. (29th), Axa Lebensversicherung AG (33rd) and Bayern-Versicherung Lebensversicherung AG (35th) are only in the midfield.

In the lower third placed are the R+V Lebensversicherung AG (rank 40), the Generali Germany life insurance AG (in 48th place) and the Zurich German Herold life insurance AG (position 50).

Taken from the article: