2011 US Food

Financial Strength Rankings using Artificial Intelligence

| Top rated | 3 of 15 |

| Best rating | 225 % |

| Worst rating | 154 % |

| New companies | 12 |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 3 of 15 |

| Best rating | 225 % |

| Worst rating | 154 % |

| New companies | 12 |

| Negative Economic Capital Ratio |

Keurig Green Mountain INC climbed -2 positions from 1 to 3 due to its excellent Liabilities.Hershey CO lost 12 positions from 3 to 15 due to its bad Stockholders Equity.Lancaster Colony CORP entered the 2011 ranking at rank 1, making it the best newcomer.The biggest company by assets, Mondelez International Inc, is only ranked at place 14 whereas the smallest company, Lancaster Colony CORP, is financially stronger at rank 1.

| Revenues | 162 B |

| Assets | 188 B |

| Expenses | 153 B |

| Stockholders Equity | 88.7 B |

| Unprofitable Companies |

| Rank | Company | Seal | Rating Value | Trend | ||

|---|---|---|---|---|---|---|

| 1 | Lancaster Colony CORP | 225.37% | 0.0 | ||

| 2 | KELLANOVA | 204.18% | 0.0 | ||

| 3 | Keurig Green Mountain INC | 201.21% | -2.0 | ||

| 4 | Tootsie ROLL Industries INC | 196.07% | 0.0 | ||

| 5 | Tyson Foods INC | 195.40% | 0.0 | ||

| 6 | Ingredion Inc | 195.03% | 0.0 | ||

| 7 | DEAN Foods CO | 193.63% | 0.0 | ||

| 8 | Hillshire Brands Co | 185.97% | 0.0 | ||

| 9 | Mccormick CO INC | 167.55% | 0.0 | ||

| 10 | Conagra Brands INC | 159.78% | 0.0 | ||

| 11 | Treehouse Foods Inc | 157.98% | 0.0 | ||

| 12 | Ralcorp Holdings INC MO | 157.63% | 0.0 | ||

| 13 | General Mills INC | 156.92% | 0.0 | ||

| 14 | Mondelez International Inc | 156.22% | -12.0 | ||

| 15 | Hershey CO | 153.54% | -12.0 | ||

| Rank | Company | Seal | Rating Value | Trend |

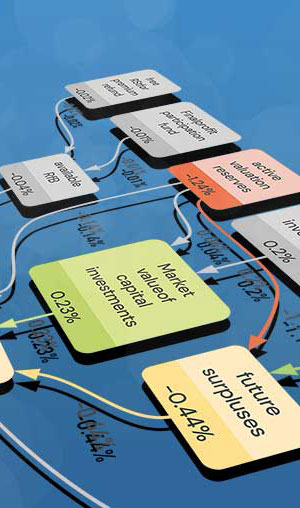

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai