2022 US Computers

Financial Strength Rankings using Artificial Intelligence

| Top rated | 7 of 29 |

| Best rating | 824 % |

| Worst rating | -1,349 % |

| New companies | 3 |

| Negative Economic Capital Ratio | 2 of 29 |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 7 of 29 |

| Best rating | 824 % |

| Worst rating | -1,349 % |

| New companies | 3 |

| Negative Economic Capital Ratio | 2 of 29 |

Mandiant Inc climbed 17 positions from 23 to 6 due to its excellent Net Income.Palo Alto Networks Inc lost 17 positions from 7 to 24 due to its bad Liabilities, Current.Markforged Holding Corp entered the 2022 ranking at rank 10, making it the best newcomer.

| Revenues | 571 B |

| Assets | 681 B |

| Expenses | 456 B |

| Stockholders Equity | 161 B |

| Unprofitable Companies | 9 of 29 |

| Rank | Company | Seal | Rating Value | Trend | ||

|---|---|---|---|---|---|---|

| 1 | Wetouch Technology Inc | 823.58% | 0.0 | ||

| 2 | Immersion Corp | 472.63% | 3.0 | ||

| 3 | Interlink Electronics Inc | 456.73% | -1.0 | ||

| 4 | ONE Stop Systems INC | 450.41% | 0.0 | ||

| 5 | Arista Networks Inc | 446.37% | -2.0 | ||

| 6 | Mandiant Inc | 415.87% | 17.0 | ||

| 7 | A10 Networks Inc | 406.98% | 7.0 | ||

| 8 | Digi International INC | 384.82% | -2.0 | ||

| 9 | Identiv Inc | 383.51% | 13.0 | ||

| 10 | Markforged Holding Corp | 348.53% | 0.0 | ||

| 11 | Transact Technologies Inc | 295.89% | 2.0 | ||

| 12 | Evolv Technologies Holdings Inc | 253.16% | 0.0 | ||

| 13 | Omnicell INC | 245.67% | -2.0 | ||

| 14 | Cisco Systems INC | 241.28% | -5.0 | ||

| 15 | F5 INC. | 234.73% | -5.0 | ||

| 16 | Apple Inc | 232.98% | -1.0 | ||

| 17 | Super Micro Computer Inc | 231.68% | -9.0 | ||

| 18 | Extreme Networks INC | 229.80% | 1.0 | ||

| 19 | Lantronix INC | 229.71% | -2.0 | ||

| 20 | Corsair Gaming Inc | 215.69% | 0.0 | ||

| 21 | HP INC | 212.89% | -1.0 | ||

| 22 | Juniper Networks INC | 208.12% | -10.0 | ||

| 23 | BIO KEY International INC | 170.13% | 2.0 | ||

| 24 | Palo Alto Networks Inc | 159.39% | -17.0 | ||

| 25 | Xerox Holdings Corp | 121.76% | -9.0 | ||

| 26 | Fortinet Inc | 106.72% | -8.0 | ||

| 27 | International Business Machines | 73.58% | -3.0 | ||

| 28 | Dror Ortho Design Inc | -563.58% | -2.0 | ||

| 29 | Intrusion INC | -1349.08% | -8.0 | ||

| Rank | Company | Seal | Rating Value | Trend |

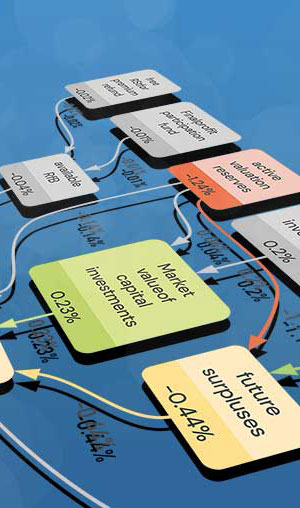

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

Source: https://openai.com/dall-e-3/ The results for RealRate’s 2024 ranking for the U.S. Petroleum [...]

Source: https://openai.com/dall-e-3/ The results for RealRate’s 2024 ranking for the U.S. Aviation [...]

🚀 RealRate is raising! At realrate.ai, we’re revolutionizing financial ratings and analytics [...]

Last week, Dr. Holger Bartel, CEO of RealRate, pitched the business, showing how [...]

Earlier in September in Berlin, Dr. Holger Bartel, CEO of RealRate, hosted an [...]

Source: https://openai.com/dall-e-3/ The results for RealRate’s 2024 ranking for the U.S. Life [...]

Source: https://www.germanaccelerator.com Some incredible news at RealRate, folks! We have been [...]

Last week Dr. Holger Bartel, CEO at RealRate, took part in a very [...]

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai