2018 DE Disability

Financial Strength Rankings using Artificial Intelligence

| Top rated | 14 of 57 |

| Best rating | 3,79 % |

| Worst rating | -0,152 % |

| New companies | 2 |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 14 of 57 |

| Best rating | 3,79 % |

| Worst rating | -0,152 % |

| New companies | 2 |

| Negative Economic Capital Ratio |

BL die Bayerische climbed 34 positions from 46 to 12 due to its excellent HGB-Deckungsrückstellung.HELVETIA Leben lost 28 positions from 7 to 35 due to its bad Risiko- und Übriges Ergebnis.Itzehoer Leben entered the 2018 ranking at rank 17, making it the best newcomer.

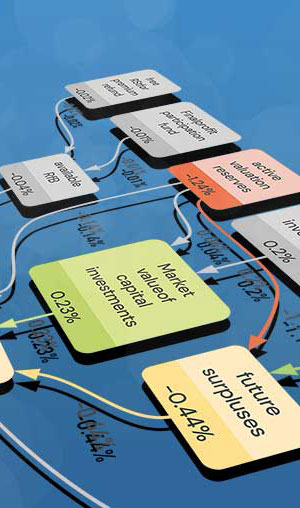

| Zinszusatzreserve | 53,5 B |

| HGB-Deckungsrückstellung | 760 B |

| Risiko- und Übriges Ergebnis | 5,36 B |

| Mittlerer Tarifrechnungszins | 1,67 |

| Aktivische Bewertungsreserven | 123 B |

In April, you’ll remember we announced that RealRate participated in the TDWI [https://www.linkedin.com/company/tdwi/] [...]

Photo source: https://openai.com/dall-e-3/ RealRate is excited to announce that the new 2024 Petrol [...]

Photo source: https://openai.com/dall-e-3/ RealRate is very excited to announce that the new 2024 [...]

Photo source: https://openai.com/dall-e-3/ RealRate is extremely excited to announce that the new 2024 [...]

Photo source: https://openai.com/dall-e-3/ RealRate is very excited to announce that the new 2024 [...]

Source: https://www.linkedin.com/posts/alina-thielemann-50417927a_versicherungsbranche-seminar-innovationen-activity-7218537507137728512-N48L?utm_source=share&utm_medium=member_ios Last Thursday, the Deutsche Versicherungsakademie (German Insurance Academy) held a [...]

Photo source: https://openai.com/dall-e-3/ RealRate is extremely excited to announce that the new [...]

Photo source: https://openai.com/dall-e-3/ We are extremely pleased to announce that on the [...]

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai