2019 US Food

Financial Strength Rankings using Artificial Intelligence

| Top rated | 9 of 39 |

| Best rating | 302 % |

| Worst rating | -981 % |

| New companies | 6 |

| Negative Economic Capital Ratio | 6 of 39 |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 9 of 39 |

| Best rating | 302 % |

| Worst rating | -981 % |

| New companies | 6 |

| Negative Economic Capital Ratio | 6 of 39 |

Planet Green Holdings Corp climbed 33 positions from 34 to 1 due to its excellent Net Income.Nate S Food Co lost 22 positions from 16 to 38 due to its bad Net Income.Coffeesmiths Collective INC entered the 2019 ranking at rank 19, making it the best newcomer.

| Revenues | 159 B |

| Assets | 224 B |

| Expenses | 146 B |

| Stockholders Equity | 102 B |

| Unprofitable Companies | 16 of 39 |

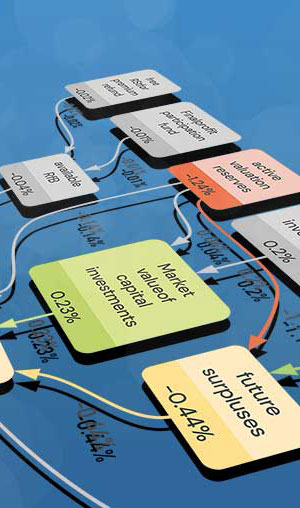

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression Plot compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

The Feature Importance Graph highlights the most important industry features for the industry. These variables have the greatest impact on financial health, shown as the last variable at the bottom of the causal graph.

In April, you’ll remember we announced that RealRate participated in the TDWI [https://www.linkedin.com/company/tdwi/] [...]

Photo source: https://openai.com/dall-e-3/ RealRate is excited to announce that the new 2024 Petrol [...]

Photo source: https://openai.com/dall-e-3/ RealRate is very excited to announce that the new 2024 [...]

Photo source: https://openai.com/dall-e-3/ RealRate is extremely excited to announce that the new 2024 [...]

Photo source: https://openai.com/dall-e-3/ RealRate is very excited to announce that the new 2024 [...]

Source: https://www.linkedin.com/posts/alina-thielemann-50417927a_versicherungsbranche-seminar-innovationen-activity-7218537507137728512-N48L?utm_source=share&utm_medium=member_ios Last Thursday, the Deutsche Versicherungsakademie (German Insurance Academy) held a [...]

Photo source: https://openai.com/dall-e-3/ RealRate is extremely excited to announce that the new [...]

Photo source: https://openai.com/dall-e-3/ We are extremely pleased to announce that on the [...]

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai