2020 DE Health Insurance

Financial Strength Rankings using Artificial Intelligence

| Top rated | 7 of 30 |

| Best rating | 23,2 % |

| Worst rating | 6,76 % |

| New companies | |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 7 of 30 |

| Best rating | 23,2 % |

| Worst rating | 6,76 % |

| New companies | |

| Negative Economic Capital Ratio |

Continentale Kranken climbed 16 positions from 29 to 13 due to its excellent Bestandsabbaurate.HUK Coburg Kranken lost 8 positions from 12 to 20 due to its bad Risiko- und Übriges Ergebnis.The biggest company by assets, Debeka Kranken, is only ranked at place 30 whereas the smallest company, Envivas Kranken, is financially stronger at rank 2.

| Revenues | 9,00 B |

| Assets | 3,01 |

| Expenses | 20,1 |

| Stockholders Equity | 6,47 B |

| Unprofitable Companies | 345 B |

| Rank | Company | Seal | Rating Value | Trend | ||

|---|---|---|---|---|---|---|

| 1 | Devk Kranken | 23.22% | 0.0 | ||

| 2 | Envivas Kranken | 16.60% | 3.0 | ||

| 3 | Ergo Kranken | 13.06% | 1.0 | ||

| 4 | R V Kranken | 12.05% | 2.0 | ||

| 5 | Provinzial Kranken | 10.69% | 3.0 | ||

| 6 | Württembergische Kranken | 10.68% | -3.0 | ||

| 7 | Hansemerkur Kranken Ag | 9.85% | 2.0 | ||

| 8 | Arag Kranken | 9.33% | 6.0 | ||

| 9 | Concordia Kranken | 9.26% | 9.0 | ||

| 10 | Universa Kranken | 9.25% | 1.0 | ||

| 11 | Alte Oldenburger Kranken Ag | 9.05% | -1.0 | ||

| 12 | Hallesche Kranken | 8.66% | 1.0 | ||

| 13 | Continentale Kranken | 8.46% | 16.0 | ||

| 14 | Münchener Verein Kranken | 8.40% | 1.0 | ||

| 15 | AXA Kranken | 8.38% | 8.0 | ||

| 16 | LVM Kranken | 8.18% | 0.0 | ||

| 17 | Generali Deutschland Kranken | 8.17% | 13.0 | ||

| 18 | Inter Kranken | 8.15% | -1.0 | ||

| 19 | Barmenia Kranken | 8.09% | 2.0 | ||

| 20 | HUK Coburg Kranken | 7.92% | -8.0 | ||

| 21 | Gothaer Kranken | 7.89% | -1.0 | ||

| 22 | Nürnberger Kranken | 7.87% | 6.0 | ||

| 23 | Signal Iduna Kranken | 7.78% | 2.0 | ||

| 24 | Süddeutsche Kranken | 7.78% | -5.0 | ||

| 25 | Versicherer Im Raum der Kirchen Kranken | 7.75% | -3.0 | ||

| 26 | Union Kranken | 7.75% | -2.0 | ||

| 27 | Allianz Kranken | 7.54% | 5.0 | ||

| 28 | DKV Deutsche Kranken | 7.51% | -2.0 | ||

| 29 | Bayerische Beamtenkrankenkasse | 7.31% | -2.0 | ||

| 30 | Debeka Kranken | 6.76% | 1.0 | ||

| Rank | Company | Seal | Rating Value | Trend |

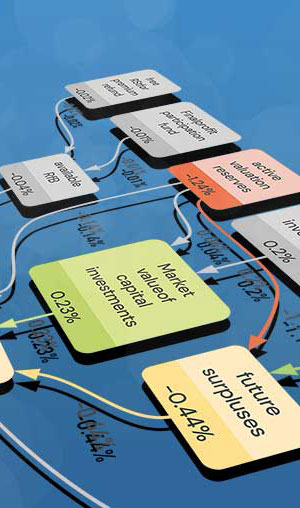

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

The RealRate Industry Index shows how the financial health of the sector has evolved over time. The evolution of the index is shown for both the median and the distribution of companies. The changes in the index are shown in the lower part.

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai