2012 US Construction

Financial Strength Rankings using Artificial Intelligence

| Top rated | 9 of 38 |

| Best rating | 186 % |

| Worst rating | -6.84 % |

| New companies | 25 |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 9 of 38 |

| Best rating | 186 % |

| Worst rating | -6.84 % |

| New companies | 25 |

| Negative Economic Capital Ratio |

NVR INC climbed -3 positions from 1 to 4 due to its excellent Expenses.Ryland Group INC lost 22 positions from 13 to 35 due to its bad Liabilities, Non-Current.Preformed Line Products Co entered the 2012 ranking at rank 1, making it the best newcomer.The biggest company by assets, Lennar Corp NEW, is only ranked at place 30 whereas the smallest company, Goldfield Corp, is financially stronger at rank 14.

| Revenues | 89.8 B |

| Assets | 75.7 B |

| Expenses | 89.0 B |

| Stockholders Equity | 35.4 B |

| Unprofitable Companies |

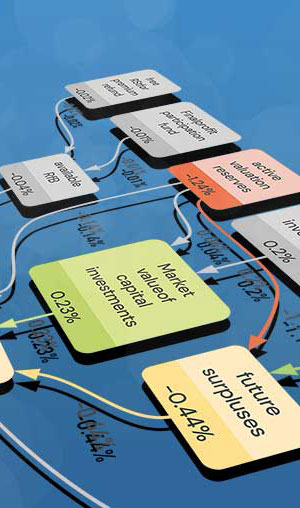

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai