2015 Risk Insurance

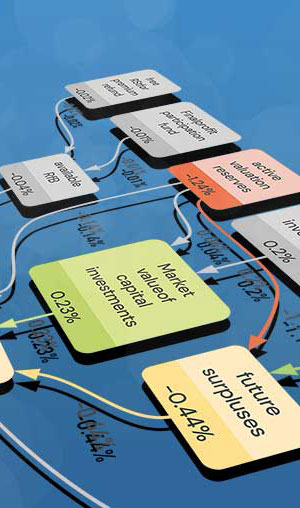

Financial Strength Rankings using Artificial Intelligence

| Top rated | 2 of 8 |

| Best rating | 53,7 % |

| Worst rating | 5,23 % |

| New companies | – |

| Negative Economic Capital Ratio | – |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 2 of 8 |

| Best rating | 53,7 % |

| Worst rating | 5,23 % |

| New companies | – |

| Negative Economic Capital Ratio | – |

The biggest company by assets, COSMOS Leben, is only ranked at place 6 whereas the smallest company, Delta Direkt Leben, is financially stronger at rank 1.

| Revenues | 32,4 B |

| Assets | 2,94 B |

| Expenses | 898 M |

| Stockholders Equity | 1,77 B |

| Unprofitable Companies | 1,25 B |

| Company | Seal | Rating Value | Trend | |||

|---|---|---|---|---|---|---|

| 1 | Delta Direkt Leben | 53.744 | 0.0 | ||

| 2 | Dialog Leben | 47.110 | 0.0 | ||

| 3 | Deutsche Lebensversicherungs-AG | 22.902 | 0.0 | ||

| 4 | EUROPA Leben | 19.067 | 0.0 | ||

| 5 | InterRisk Leben | 18.732 | 0.0 | ||

| 6 | COSMOS Leben | 8.579 | 0.0 | ||

| 7 | Hannoversche Leben | 6.452 | 0.0 | ||

| 8 | ERGO Direkt Leben | 5.226 | 0.0 | ||

| Company | Seal | Rating Value | Trend |

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai