2020 US Hotels

Financial Strength Rankings using Artificial Intelligence

| Top rated | 6 of 27 |

| Best rating | 185 % |

| Worst rating | 0 % |

| New companies | 5 |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 6 of 27 |

| Best rating | 185 % |

| Worst rating | 0 % |

| New companies | 5 |

| Negative Economic Capital Ratio |

Civeo Corp climbed 5 positions from 25 to 20 due to its excellent General and Administrative Expense.Mohegan Tribal Gaming Authority lost 8 positions from 17 to 25 due to its bad Stockholders Equity.Target Hospitality Corp entered the 2020 ranking at rank 2, making it the best newcomer.

| Revenues | 101 B |

| Assets | 204 B |

| Expenses | 90.7 B |

| Stockholders Equity | 88.5 B |

| Unprofitable Companies |

| Rank | Company | Seal | Rating Value | Trend | ||

|---|---|---|---|---|---|---|

| 1 | MGM Resorts International | 184.53% | 3.0 | ||

| 2 | Target Hospitality Corp | 181.45% | 0.0 | ||

| 3 | Pismo Coast Village INC | 177.47% | -2.0 | ||

| 4 | BOYD Gaming CORP | 158.32% | -1.0 | ||

| 5 | Marriott International INC MD | 139.37% | 0.0 | ||

| 6 | HOST Hotels Resorts L P | 131.65% | 0.0 | ||

| 7 | Hyatt Hotels Corp | 120.75% | 1.0 | ||

| 8 | Sunstone Hotel Investors Inc | 120.71% | -6.0 | ||

| 9 | Monarch Casino Resort INC | 114.16% | -2.0 | ||

| 10 | LAS Vegas Sands CORP | 111.63% | 0.0 | ||

| 11 | Choice Hotels International INC DE | 101.20% | 2.0 | ||

| 12 | Xenia Hotels Resorts Inc | 94.74% | -3.0 | ||

| 13 | Hilton Grand Vacations Inc | 86.09% | -1.0 | ||

| 14 | Bally s Corp | 81.07% | 0.0 | ||

| 15 | Extended Stay America Inc | 73.79% | 0.0 | ||

| 16 | Playa Hotels Resorts N V | 67.81% | 0.0 | ||

| 17 | Travel Leisure Co | 66.15% | 1.0 | ||

| 18 | Caesars Entertainment Inc | 64.92% | 3.0 | ||

| 19 | Sotherly Hotels LP | 60.34% | 4.0 | ||

| 20 | Civeo Corp | 60.24% | 5.0 | ||

| 21 | Red Rock Resorts Inc | 57.13% | 0.0 | ||

| 22 | WYNN Resorts LTD | 55.33% | -3.0 | ||

| 23 | PENN Entertainment Inc | 54.21% | 1.0 | ||

| 24 | FULL House Resorts INC | 50.60% | 0.0 | ||

| 25 | Mohegan Tribal Gaming Authority | 42.71% | -8.0 | ||

| 26 | Caesars Holdings INC | 41.19% | 0.0 | ||

| 27 | Syndicated Resorts Association Inc | 0.00% | 0.0 | ||

| Rank | Company | Seal | Rating Value | Trend |

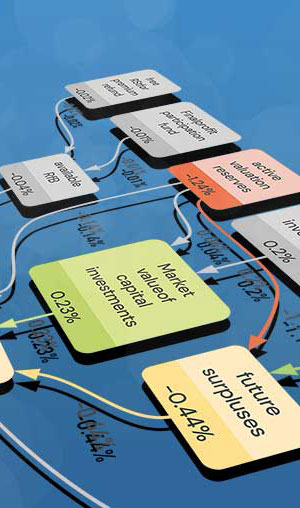

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai