2020 US Motor

Financial Strength Rankings using Artificial Intelligence

| Top rated | 12 of 50 |

| Best rating | 208 % |

| Worst rating | 5.70 % |

| New companies | 4 |

| Negative Economic Capital Ratio |

Financial Strength Rankings using Artificial Intelligence

| Top rated | 12 of 50 |

| Best rating | 208 % |

| Worst rating | 5.70 % |

| New companies | 4 |

| Negative Economic Capital Ratio |

Securetech Innovations Inc climbed 26 positions from 35 to 9 due to its excellent Assets, Current.Icahn Enterprises L P lost 8 positions from 14 to 22 due to its bad Liabilities, Noncurrent.Strattec Security CORP entered the 2020 ranking at rank 5, making it the best newcomer.

| Revenues | 312 B |

| Assets | 406 B |

| Expenses | 306 B |

| Stockholders Equity | 103 B |

| Unprofitable Companies |

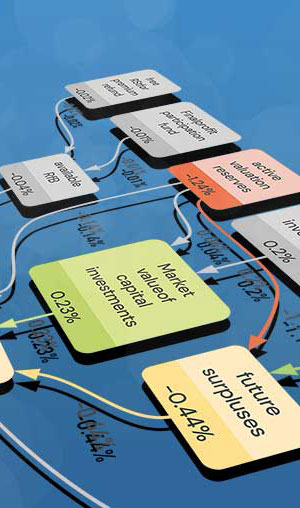

The Feature Distribution shows the main industry variables and the distribution of their impact on financial strength. The more important a variable, the broader the distribution. As the effects are calculated relative to the industry average, half of the companies have a positive effect (green) and half have a negative effect (red).

The Regression compares the forecasted company valuation with the observed stock market values. A positive correlation suggests that the model effectively explains market prices.

This year's rating information is fee-based. Please request rates at

james.woods@realrate.ai